You’ve found the house of your dreams. The offer has been accepted, and the excitement is building. But a nagging question lingers: what if there are hidden, expensive problems lurking beneath the surface? For many buyers, this fear, combined with confusing technical jargon, can make the next steps feel overwhelming. This is where a professional property survey transforms uncertainty into clarity and provides you with essential peace of mind.

Investing in the right survey isn’t just another cost; it’s one of the most critical steps you can take to protect your biggest investment. In this comprehensive guide, we will demystify the entire process. You will learn about every type of survey, understand exactly which one you need for your potential new home, and discover how to use the final report to make an informed decision. Our goal is to empower you to avoid unforeseen repair bills, negotiate effectively, and buy your next property with absolute confidence.

What is a Property Survey and Why is it Essential?

Think of a property survey as a comprehensive health check for what is likely your biggest investment. It is an independent, expert assessment carried out by a qualified surveyor for your benefit as the buyer. The core purpose is to identify any potential problems, defects, or areas of concern with the building, from major structural issues to subtle signs of damp. The professional discipline of Surveying provides the technical foundation for this crucial inspection, ensuring you receive an accurate and impartial report.

This expert insight gives you clarity and confidence, arming you with the facts you need to make an informed decision. Ultimately, a survey offers both financial protection against unforeseen costs and invaluable peace of mind before you commit to the purchase.

To see this explained in more detail, property expert Phil Spencer offers some helpful tips:

Mortgage Valuation vs. Property Survey: A Critical Difference

It is crucial not to confuse a survey with a mortgage valuation. The valuation is commissioned by your lender for their benefit, not yours. Its sole purpose is to confirm the property offers adequate security for the loan. A valuer may spend only 15-20 minutes at the property and will not provide a detailed list of repairs or highlight potential structural problems, leaving you financially exposed.

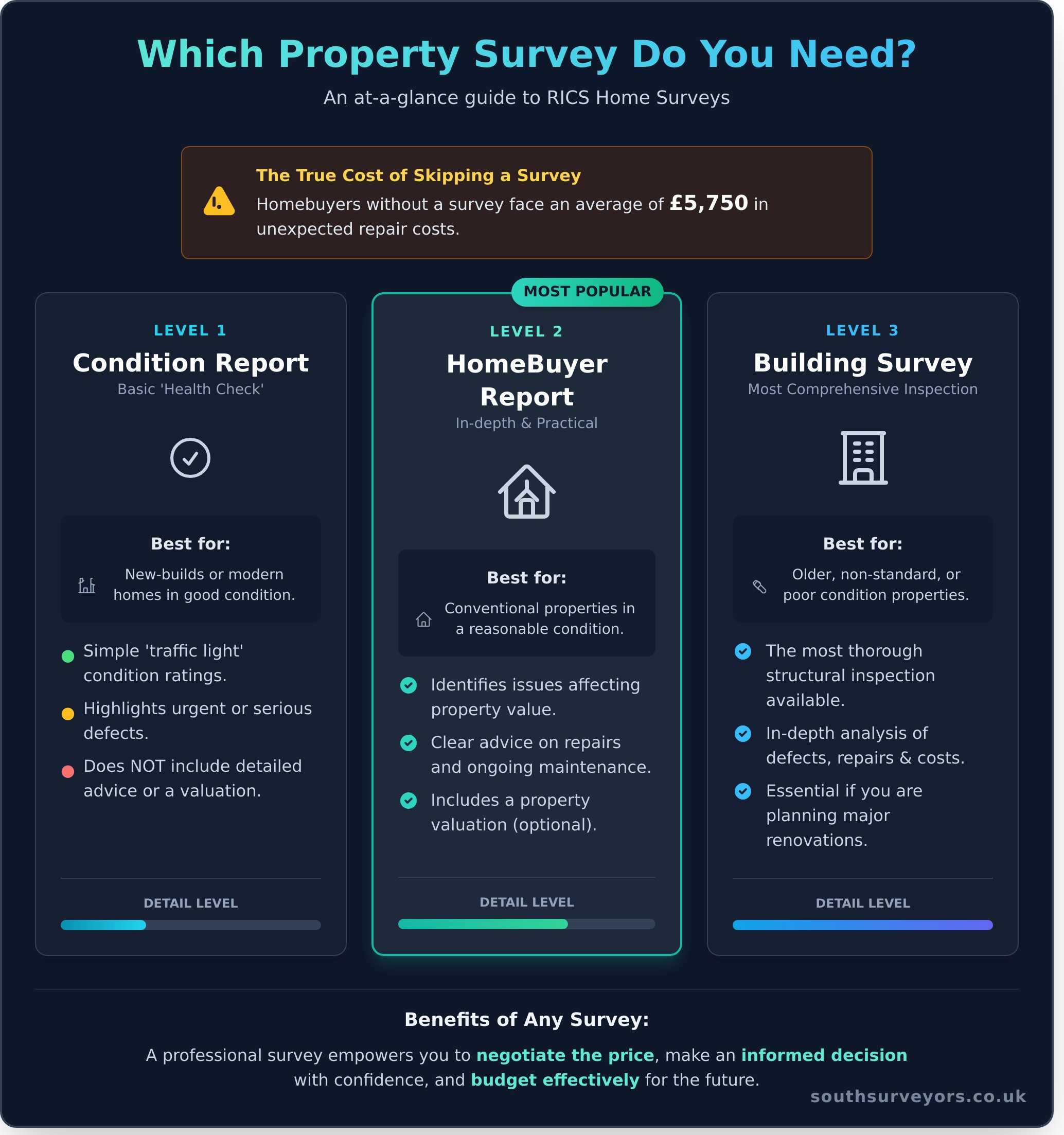

The True Cost of Skipping a Survey

Viewing the survey fee as an expense is a common but costly mistake; it is an investment in your financial security. Hidden issues like structural movement, widespread damp, or a failing roof can lead to repair bills running into thousands of pounds. According to RICS, homebuyers who don’t get a survey face an average of £5,750 in unexpected repair costs. A small upfront investment can prevent a significant financial shock later on.

Key Benefits for You as a Homebuyer

A comprehensive report from a RICS-Certified surveyor empowers you in several critical ways:

- Gain a powerful negotiation tool: If the survey uncovers issues, you can use the report to renegotiate the purchase price or request that the seller completes repairs before the sale.

- Make an informed decision: Move forward with real confidence, knowing the true condition of the property and making a choice based on facts, not emotion.

- Budget effectively for the future: The report provides a clear understanding of the property’s condition, allowing you to plan and budget for any necessary maintenance or repairs.

Decoding the Different RICS Property Surveys

When you commission a property survey in the UK, you are investing in a service governed by the highest professional standards. The Royal Institution of Chartered Surveyors (RICS) is the globally recognised body that sets and regulates these standards, ensuring you receive expert, impartial, and reliable advice. Much like how international bodies such as the National Society of Professional Surveyors work to uphold industry integrity, RICS provides UK homebuyers with clarity and peace of mind. To simplify the options, think of the three main RICS Home Surveys as a basic, standard, and advanced health check for your potential new home.

RICS Home Survey – Level 1 (Condition Report)

This is the most basic survey, designed to give you a clear, concise overview of the property’s condition. It uses a simple ‘traffic light’ system (red, amber, green) to rate different parts of the property, highlighting any urgent or serious defects. It’s best suited for new-builds or modern, conventional homes that appear to be in good condition. While it provides a useful snapshot, it does not include detailed advice or a valuation.

RICS Home Survey – Level 2 (HomeBuyer Report)

As the most popular choice for homebuyers, the Level 2 survey is ideal for conventional properties that are in a reasonable state of repair. It goes into more detail than the Level 1 report, identifying issues that could affect the property’s value and providing advice on necessary repairs and maintenance. This survey gives you the crucial information needed for price negotiations and is available with or without a property valuation.

RICS Home Survey – Level 3 (Building Survey)

The most comprehensive and detailed inspection available, a Level 3 Building Survey is strongly recommended for older properties (typically over 50 years old), buildings of unusual construction, or any property that is visibly in poor condition. This in-depth property survey provides a thorough analysis of the building’s structure and fabric, along with detailed advice on defects, repairs, and maintenance. It is essential if you are planning any major works or renovations.

Which Survey is Right for Your Property? A Simple Checklist

Use this simple guide to help you select the most appropriate survey for your circumstances. Making the right choice ensures you have the information you need to proceed with confidence.

- Level 1 (Condition Report) is best for: A modern, conventional home (less than 10 years old) that appears to be in excellent condition.

- Level 2 (HomeBuyer Report) is best for: A standard property in reasonable condition where you need assurance on its structural integrity and value.

- Level 3 (Building Survey) is best for: An older property, a building of non-standard construction, a property in need of renovation, or if you are planning major works.

Choosing the right survey is a critical step in your property journey, providing you with the expert knowledge to make an informed decision. Still unsure? Contact our experts for tailored advice.

The Property Survey Process: What to Expect

Once you’ve had an offer accepted, the property survey process begins. This structured journey is designed to give you complete clarity and confidence before you commit to the purchase. Understanding the key stages, from selecting a professional to deciphering your final report, helps manage expectations and ensures you get the most value from your investment. A typical timeline, from instruction to receiving your report, is around 5-10 working days.

How to Choose a RICS Chartered Surveyor

The quality of your survey depends entirely on the expertise of your surveyor. To ensure you receive a thorough and reliable assessment, we recommend you:

- Verify Credentials: Only use firms that are ‘Regulated by RICS’ (Royal Institution of Chartered Surveyors). This is your guarantee of professionalism and high standards.

- Compare Quotes: Obtain quotes from at least two or three different firms to compare service levels and costs.

- Prioritise Local Knowledge: A surveyor with extensive experience in the local area will have invaluable insight into common property types and potential issues, such as subsidence or specific flood risks.

- Check Reviews & Samples: Look at recent client reviews and ask to see a sample report to ensure it is clear, comprehensive, and easy to understand.

What Happens During the On-site Inspection?

The on-site inspection is a meticulous, non-invasive visual examination of the property’s condition. Your surveyor will not drill holes, lift floorboards, or move heavy furniture. Instead, they use their expert eye and specialist equipment, like a damp meter, to assess all accessible parts of the property. This includes a detailed check of the roof, walls, floors, windows, and visible services (electrics, plumbing). They will also assess the grounds, looking at outbuildings, drainage, and the general state of the boundaries; Understanding your property boundaries is a key part of assessing the asset you are buying.

Receiving and Understanding Your Survey Report

After the inspection, your surveyor will compile their findings into a comprehensive report. Most RICS reports use a simple traffic-light system (Condition Ratings 1, 2, and 3) to highlight the urgency of any issues found. We advise reading the summary section first to get an overview, then delving into the detailed sections for specific concerns.

Crucially, the report is just the start of the conversation. A professional surveyor will be happy to talk you through their findings over the phone, answering any questions you may have. Remember, no property is perfect. The purpose of a professional property survey is not to get a ‘pass’ or ‘fail’, but to provide you with the essential information needed to proceed with confidence, renegotiate the price, or walk away from a potentially costly mistake. It’s this expert guidance that transforms a complex document into a powerful decision-making tool.

After the Survey: Turning Your Report into an Action Plan

Receiving your report is arguably the most crucial step in the home-buying process. This isn’t a list of problems; it’s your roadmap to making a confident and informed decision. A professional property survey empowers you by replacing uncertainty with facts, transforming potential issues into a clear, manageable strategy. The focus now shifts from discovery to action.

Prioritising the Surveyor’s Recommendations

Your RICS report will likely categorise findings using a traffic light system (Red, Amber, Green) to indicate urgency. Begin by focusing on the ‘Red’ items—these are serious defects requiring urgent attention, such as structural movement or a failing roof. Differentiate between essential repairs needed to make the property safe and habitable, and desirable improvements you might want to make later. This prioritisation forms the basis of your next steps.

Getting Quotes for Remedial Work

To understand the true financial impact of the survey’s findings, you must get quotes. We recommend obtaining at least three detailed quotations from qualified, reputable tradespeople for any significant work highlighted. These figures aren’t just estimates; they are real-world costs that provide a solid foundation for any subsequent negotiations. Don’t hesitate to ask your surveyor if they can recommend specialists for issues like damp-proofing or structural repairs.

How to Renegotiate the Property Price

Armed with your survey and professional quotes, you can now approach the estate agent with a clear, evidence-based position. Present the facts calmly and reasonably, focusing on significant, unexpected costs that the seller’s asking price did not account for. There are three common outcomes:

- A price reduction: The seller agrees to lower the asking price to cover all or part of the repair costs.

- The seller fixes the issues: The seller may offer to have the repairs completed by qualified professionals before the exchange of contracts.

- Meeting in the middle: A compromise is reached where the cost is shared between you and the seller.

Ultimately, a comprehensive report gives you the leverage to ensure you pay a fair price for the property in its true condition. Our detailed reports provide the clarity you need for successful negotiations.

Secure Your Investment with Clarity and Confidence

Buying a home is a significant commitment, and as we’ve explored, a professional survey is your most vital tool for protecting that investment. Understanding the different RICS levels and turning your report into an actionable plan are the keys to avoiding costly surprises. A comprehensive property survey isn’t an expense; it’s an investment in peace of mind, giving you the power to negotiate effectively and purchase with genuine confidence.

At South Surveyors, our mission is to provide that clarity. As local experts serving South London and the surrounding areas, we are regulated by RICS to ensure the highest professional standards. Our team delivers clear, comprehensive reports designed to empower your decisions and safeguard your future home.

Gain the clarity and confidence you deserve in your property purchase. Get a free, no-obligation quote from South Surveyors today.

Frequently Asked Questions About Property Surveys

How much does a property survey cost in the UK?

The cost of a property survey depends on the property’s value, size, and the level of detail required. A RICS Home Survey Level 2 typically costs between £400 and £1,000. For a more comprehensive RICS Home Survey Level 3 (Building Survey), which is recommended for older or more complex properties, you can expect to pay from £600 to over £1,500. Investing in a professional survey is a crucial step for gaining peace of mind and avoiding unforeseen repair costs.

Do I really need a survey for a new-build property?

Yes, we strongly recommend it. While new-builds come with a warranty, they can still have defects ranging from minor cosmetic “snags” to more significant construction issues. An independent, professional snagging survey provides you with a comprehensive list of issues for your developer to rectify. This ensures your new home meets the highest standards from day one, giving you real confidence in your purchase and preventing future disputes over what should have been fixed upon completion.

What are the biggest ‘red flags’ a surveyor looks for?

Our RICS-Certified surveyors are trained to identify critical issues that an untrained eye might miss. The most significant red flags include signs of structural movement (like significant cracking), evidence of damp (both rising and penetrating), major roofing defects, and timber decay or infestation (such as rot or woodworm). They also thoroughly inspect drainage, wiring, and plumbing systems for any immediate or potential problems, ensuring you have a clear picture of the property’s health.

How long does a survey inspection take and when will I get the report?

The on-site inspection time varies by survey level. A Level 2 survey typically takes 2-4 hours, while a more in-depth Level 3 survey can take most of the day. We are committed to providing you with clarity as quickly as possible. Following the inspection, you can expect to receive your comprehensive, easy-to-understand report within 3-5 working days. Often, our surveyor will call you shortly after the inspection to provide a brief verbal summary of any major findings.

Can a property ‘fail’ a survey?

A property doesn’t “pass” or “fail” a survey in the way a car might fail an MOT. Instead, a property survey is a detailed, objective report on the building’s current condition. It identifies defects, assesses their urgency, and provides professional advice on repairs and maintenance. The report is a tool that empowers you to make an informed decision—whether to proceed with the purchase, renegotiate the price based on the findings, or decide the property isn’t the right investment for you.

Should I share the survey report with the seller or estate agent?

The survey report is commissioned by you and belongs to you. However, it can be a powerful negotiation tool. If the survey uncovers significant issues that require costly repairs, it is often wise to share the relevant sections of the report with the estate agent and seller. This provides impartial, expert evidence to support your request for a price reduction or for the seller to carry out repairs before the sale completes, ensuring a fair transaction for all parties.

What’s the difference between a surveyor and a structural engineer?

A RICS-certified surveyor assesses the overall condition of a property, identifying a broad range of potential defects, from the roof to the foundations. If they identify a specific and potentially serious structural problem, such as major cracking or subsidence, they will recommend further investigation by a structural engineer. The engineer is a specialist who will then conduct a focused analysis of that specific structural issue and design a technical solution for any necessary repairs.