Imagine the worst has happened – a fire or flood has severely damaged your property. In that moment of distress, the last thing you need is the discovery that your insurance policy won’t cover the full cost of rebuilding. For many UK homeowners, this is a real and devastating risk, often stemming from a common misunderstanding between a home’s market value and its actual rebuild cost. This is precisely where a professional reinstatement cost assessment provides crucial clarity and confidence, protecting your most valuable asset.

In this clear guide, our RICS-Certified experts will explain exactly what a Reinstatement Cost Assessment involves and why it is essential for securing the right level of building insurance. We will demystify the key factors that determine your property’s true rebuild value, empowering you to avoid the twin dangers of paying too much for your premium or facing a catastrophic financial shortfall when you need to make a claim. Gain the peace of mind that comes from knowing you are correctly and comprehensively protected.

What is a Reinstatement Cost Assessment (RCA)?

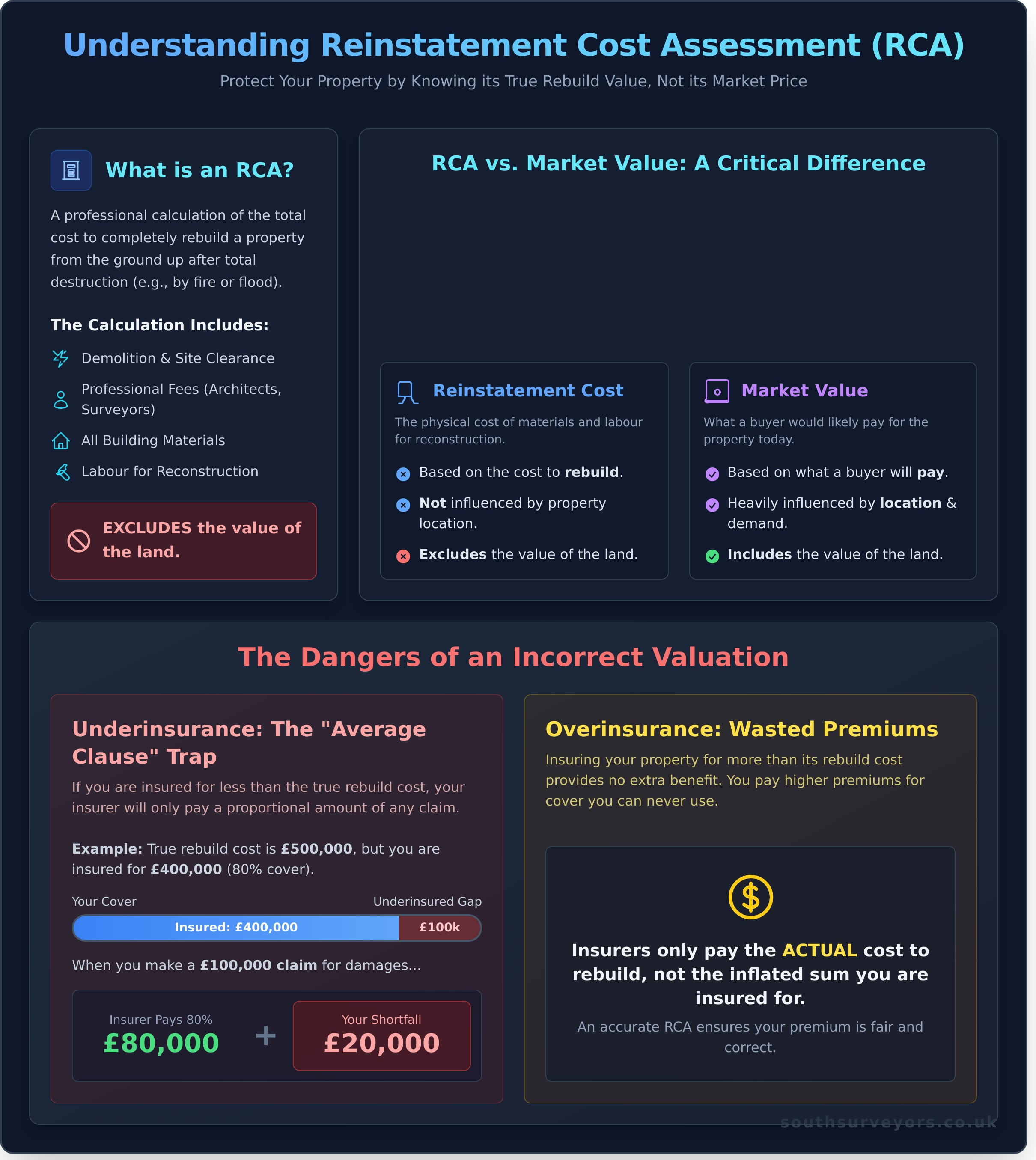

A Reinstatement Cost Assessment (RCA) is a professional calculation that determines the total cost to completely rebuild a property from the ground up in the event of its total destruction, for example, by fire or flood. This figure is crucial for arranging the correct level of buildings insurance. An accurate RCA ensures you have sufficient cover to reinstate your property without being left out of pocket, a fundamental principle of property insurance.

To provide further clarity on this essential valuation, our RICS-Certified surveyors have outlined the key details below.

A professional reinstatement cost assessment is a meticulous process. The calculation accounts for every anticipated expense required to restore the property to its original condition. This typically includes:

- The cost of demolishing the existing structure and clearing the site.

- Professional fees for architects, surveyors, and engineers.

- All building materials, from foundations to roof tiles.

- The cost of labour for the entire reconstruction project.

Crucially, the assessment explicitly excludes the value of the land itself, as the land would still remain even if the building were destroyed.

RCA vs. Market Valuation: The Critical Difference

Property owners often confuse reinstatement cost with market value, but they are fundamentally different figures. Market value is what a buyer would likely pay for your property today, heavily influenced by location and demand. In contrast, the reinstatement cost is purely about the physical expense of reconstruction. For example, a small flat in Chelsea may have a market value of over £1 million due to its postcode, but its reinstatement cost could be significantly lower.

| Market Value | Reinstatement Cost |

|---|---|

| Based on what a buyer will pay. | Based on the cost to rebuild. |

| Heavily influenced by location. | Not influenced by location. |

| Includes the value of the land. | Excludes the value of the land. |

Why Your Insurer’s Estimate Might Be Wrong

While insurers provide an estimated rebuild cost, relying solely on this figure can be a significant risk. These estimates are often generated using generic calculators or index-linking, which can be inaccurate. They may fail to account for unique aspects of your property, such as non-standard construction materials or complex architectural features. Furthermore, index-linking can lag dangerously behind sudden spikes in material and labour costs, leaving you underinsured. An inaccurate estimate places the financial risk of a shortfall squarely on you, the property owner.

The Dangers of an Incorrect Valuation: Underinsurance and Overinsurance

Securing an accurate, professional valuation is the single most important reason to invest in a reinstatement cost assessment. An incorrect figure, whether too high or too low, can lead to significant financial penalties. Insurers operate on precise calculations, and any discrepancy in your property’s rebuild value can leave you either dangerously exposed or needlessly out of pocket. Understanding these two risks—underinsurance and overinsurance—is key to protecting your property investment with clarity and confidence.

Underinsurance Explained: The ‘Average Clause’ Trap

The most severe risk is underinsurance. If your property is insured for less than its true rebuild cost, insurers can apply a penalty known as the ‘Average Clause’ when you make a claim. This means they will only pay a percentage of your claim, proportional to the level of your underinsurance. While online estimators can help you calculate your home’s rebuild cost for a basic idea, they often miss the nuances a professional survey captures.

Consider this simple example:

- Actual Rebuild Cost: £500,000

- Your Sum Insured: £400,000 (You are insured for only 80% of the true value)

- You Make a Claim for Damage: £100,000

Because you are only 80% insured, the insurer will only pay 80% of your claim. They will pay out £80,000, leaving you with a £20,000 shortfall that you must fund yourself.

Overinsurance: Are You Paying Too Much for Premiums?

While it may seem safer to insure your property for a higher value, overinsurance provides no extra benefit and is a waste of money. In the event of a total loss, an insurer will only ever pay the actual cost to rebuild the property, not the inflated figure you are insured for. This means you are paying unnecessarily high premiums year after year for coverage you can never claim. An accurate reinstatement cost assessment ensures your premium is fair, correct, and aligned with the real risk.

Who Needs a Professional RCA?

A professional assessment is crucial for a wide range of property owners to ensure they have the correct level of cover. This includes:

- Individual homeowners seeking peace of mind that their most valuable asset is fully protected.

- Freeholders of blocks of flats, who often have a legal and leasehold obligation to insure the building correctly on behalf of residents.

- Landlords and property managers who are responsible for arranging insurance for their portfolios.

- Owners of listed buildings or properties of non-standard construction, where rebuild costs are complex and cannot be estimated by standard calculators.

The Reinstatement Cost Assessment Process: What to Expect

For many property owners, the idea of a formal valuation can seem complex. However, a professional reinstatement cost assessment is a straightforward and methodical process designed to provide you with clarity and confidence. It is always conducted by a qualified, RICS-Certified surveyor who follows a structured approach to ensure every detail is captured accurately. Understanding these steps helps demystify the process, showing you exactly how we arrive at a reliable rebuild figure for your property.

To give you peace of mind, we’ve outlined the key stages you can expect when you commission an assessment with us. Your input is valuable, and providing our surveyor with accurate property information at the start helps ensure a smooth and efficient process.

Step 1: Data Gathering and Desktop Review

The process begins before we even set foot on your property. Our surveyor will start by gathering initial information, such as the property’s address, age, and construction type. To build a comprehensive picture, we will ask if you have access to key documents like floor plans, deeds, or details of any significant alterations. This initial desktop research allows our expert to prepare thoroughly for the physical inspection, ensuring maximum efficiency on the day.

Step 2: The On-Site Inspection

This is the most hands-on stage, where a RICS-Certified surveyor visits your property. Their objective is to conduct a thorough and meticulous inspection. During the visit, they will:

- Take precise measurements of the entire property to calculate the gross internal area.

- Assess the construction methods and the specific materials used, from the foundations and brickwork to the roofing materials.

- Carefully note any unique or specialist features that would impact rebuilding costs, such as period details, bespoke joinery, or complex roof structures.

- Consider external factors, including site access, demolition costs, and the surrounding environment.

Step 3: Cost Calculation and Final Report

With all the data gathered, the surveyor returns to the office to perform the final calculations. Using the detailed measurements and on-site observations, they apply current costings sourced from the official RICS Building Cost Information Service (BCIS). This ensures the final figure is based on up-to-date, industry-standard data. The result is a comprehensive report that provides a detailed breakdown and a definitive rebuild figure, giving you the accurate information you need for your insurance policy. Need a reliable RCA? Contact our expert team.

Key Factors That Influence Your Reinstatement Cost

A common source of confusion for property owners is why two seemingly similar houses can have vastly different rebuild costs. The answer lies in the detailed, methodical approach of a professional reinstatement cost assessment, which looks far beyond square footage to evaluate a wide range of specific variables. Understanding these factors provides clarity and gives you real confidence that your property is accurately insured.

To help you understand what our RICS-Certified surveyors look for, here are the key elements that influence the final calculation.

Property Age and Type

The age and architectural style of your home are significant cost drivers. Rebuilding a Grade II listed building, for example, requires adherence to strict heritage guidelines and the use of specialist craftsmen and authentic materials, such as lime mortar or handmade bricks. Period features like original sash windows, ornate cornicing, and intricate fireplaces all contribute to a higher reinstatement value compared to a modern home built with standard, readily available materials.

Construction Materials

The materials used in your home’s core structure are a primary consideration. A standard brick and block construction is more straightforward to cost and rebuild than a property with non-standard construction, such as a timber frame or specialist concrete system. Our comprehensive assessment considers every detail, including:

- Structural Elements: The type of foundations, walls, and flooring systems used.

- Roofing: The cost difference between natural slate and standard concrete tiles can be substantial.

- Internal Finishes: High-specification kitchens, luxury bathroom fittings, and bespoke joinery are all factored into the total rebuild value.

Location and Site Complexity

Where your property is located has a direct impact on cost. Rebuilding in a dense urban area like London is typically more expensive due to higher labour costs and logistical challenges. The assessment also accounts for site-specific complexities, such as difficult access for machinery, the need for extensive scaffolding, or a sloping plot. The final figure includes allowances for crucial enabling works, including professional fees for safe demolition, site clearance, and making the area secure before construction can begin.

Professional Fees and VAT

A complete reinstatement cost assessment goes beyond materials and labour. A rebuild project requires a team of professionals to ensure it is completed safely and to regulation. The final figure therefore includes a contingency for these essential services, which can represent 10-20% of the total cost. These typically include fees for:

- Architects and designers

- Chartered Surveyors

- Structural Engineers

- Planning and building control applications

Crucially, the assessment must also clarify the position on VAT. The cost of rebuilding a property is subject to VAT, and ensuring this is correctly accounted for is vital to avoid a major shortfall in your insurance cover.

Why You Must Use a RICS Chartered Surveyor for an RCA

When it comes to protecting your property, guesswork is a risk you cannot afford. While online calculators and basic insurer estimates offer a rough idea, a formal reinstatement cost assessment (RCA) is a professional valuation, not a vague approximation. Entrusting this crucial task to a RICS Chartered Surveyor is the only way to ensure the figure is accurate, reliable, and provides complete peace of mind.

RICS Regulation and Professional Standards

The Royal Institution of Chartered Surveyors (RICS) sets the global standard for property professionalism. Choosing a RICS-regulated firm means you are protected by a stringent framework of quality and accountability. Our surveyors are:

- Bound by strict ethical codes: They must act with integrity and provide impartial, expert advice that serves your best interests.

- Required to have Professional Indemnity Insurance: This provides an essential layer of protection and accountability for the advice given.

- Committed to lifelong learning: RICS members must continually update their skills and knowledge, ensuring your assessment is based on current best practices.

This rigorous oversight guarantees a professional and trustworthy service from start to finish.

Access to Authoritative Costing Data (BCIS)

A key differentiator for a RICS surveyor is their access to the Building Cost Information Service (BCIS). This is the definitive source of detailed, up-to-date cost data for the UK construction industry. Instead of relying on generic regional averages, we use BCIS data to analyse specific costs for materials, labour, and professional fees relevant to your property’s unique characteristics. This evidence-based approach ensures your final reinstatement cost assessment is a precise calculation, not a speculative estimate.

Providing Clarity and Confidence

Ultimately, using a RICS Chartered Surveyor transforms uncertainty into confidence. You receive a comprehensive report with a credible, defensible valuation that your insurer can rely on. This prevents the dual risks of over-insurance (paying unnecessarily high premiums) and under-insurance (facing a devastating financial shortfall after a loss). By investing in a professional assessment, you gain the absolute assurance that your property is correctly and adequately protected.

Choose clarity and confidence. Book your RICS assessment today.

Secure Your Property with a Professional Reinstatement Cost Assessment

Ultimately, safeguarding your property against unforeseen events begins with an accurate valuation. As we have explored, the financial risks of underinsurance can be devastating, while overinsurance leads to unnecessarily high premiums. This is why a professional reinstatement cost assessment is not just a recommendation but an essential part of responsible property ownership. It provides the only reliable figure for rebuilding your property from the ground up, ensuring you are neither exposed to risk nor overpaying for your cover.

For complete clarity and confidence, entrust this critical task to a regulated expert. At South Surveyors, our team is regulated by RICS and combines deep local expertise across South London with the highest industry standards. We deliver clear, professional reports designed for your peace of mind. Don’t leave your most significant investment to chance. Get a quote for your RICS Reinstatement Cost Assessment today and take the definitive step towards securing your property’s future.

Frequently Asked Questions About Reinstatement Cost Assessments

How often should I have a Reinstatement Cost Assessment updated?

To ensure you remain adequately insured, we recommend updating your assessment every three to five years, or whenever you make significant alterations to your property. Building material costs and labour rates fluctuate over time due to inflation and market changes. A regular, professional review by a RICS-Certified surveyor provides the peace of mind that your buildings insurance sum insured is accurate, protecting you from the significant financial risks of underinsurance in the event of a total loss.

Does my mortgage valuation report include a reinstatement cost?

A mortgage valuation report often includes a basic reinstatement figure for the lender’s insurance purposes, but this is not a substitute for a detailed assessment. This figure is typically a brief, desktop calculation and may not accurately reflect your property’s unique features. For true clarity and confidence, a dedicated reinstatement cost assessment provides a thorough, site-specific calculation, ensuring your final sum insured is comprehensive and reliable, protecting your most valuable asset correctly.

My property is a Grade II listed building. How does this affect the RCA?

A Grade II listing has a significant impact on the reinstatement cost. The assessment must account for the legal requirement to rebuild using traditional, often costly, materials and specialist craftsmanship to match the original structure. Factors like lime mortar, reclaimed bricks, or bespoke joinery increase costs substantially compared to modern equivalents. Our expert surveyors have the specialist knowledge required to accurately assess these unique heritage properties, ensuring your insurance coverage is sufficient for a like-for-like rebuild.

Can I do my own reinstatement cost calculation using an online tool?

While online calculators can provide a rough estimate, they are no substitute for a professional assessment and can lead to dangerous underinsurance. These tools cannot account for specific property features, local labour costs, demolition expenses, or professional fees. Relying on an inaccurate online figure could leave you with a devastating shortfall if you need to make a claim. Only an expert, on-site assessment from a RICS-Certified professional can provide the accurate figure you need for complete protection.

How long does the entire RCA process take from start to finish?

The process is efficient and designed to provide you with a swift, reliable outcome. Following your instruction, a site visit is arranged, which typically takes a few hours depending on the property’s size and complexity. After the inspection, our RICS-Certified surveyor will conduct detailed calculations and compile the comprehensive report. You can typically expect to receive your final, thorough assessment report within 5 to 7 working days, giving you the clarity you need without unnecessary delay.

What is the difference between a Reinstatement Cost Assessment and a survey?

These are two distinct services with different purposes. A Reinstatement Cost Assessment calculates the total cost to completely rebuild your property from the ground up for insurance purposes. In contrast, a property survey (such as a RICS Home Survey Level 2 or 3) assesses the current condition of the building, identifying any defects or repair issues for a potential buyer. While both are carried out by expert surveyors, an RCA is for insurance, while a survey is for due diligence before a purchase.