You’re scrolling through property listings, and the term keeps appearing: maisonette. Is it simply a more elegant name for a flat, or is it a different type of home altogether? This common uncertainty can quickly lead to more pressing questions for potential buyers. Who is responsible for roof repairs? What are the implications of a leasehold versus a freehold? And what about potential noise from neighbours? These are valid concerns that can make or break a property decision, leaving you feeling unsure how to proceed.

Making an informed property purchase requires clarity and confidence. This comprehensive guide is designed to provide just that, giving you the expert insight needed to navigate your options. We will provide a clear, simple definition of a maisonette, explore the key structural and legal differences compared to flats and houses, and weigh the unique pros and cons. By the end, you will have the professional knowledge to view a maisonette with peace of mind, armed with the right questions to ask before you consider making an offer.

Key Takeaways

- Learn the defining features of a maisonette, such as its private entrance, which clearly distinguishes it from a typical flat.

- Weigh the distinct advantages, like greater privacy, against potential disadvantages such as shared building responsibilities, to make an informed decision.

- Grasp the crucial legal implications of leasehold ownership and why the remaining lease term can significantly impact your purchase.

- Discover why a professional RICS survey is essential to identify unique structural risks and shared maintenance liabilities before you commit.

Defining a Maisonette: More Than Just a Flat with its Own Door

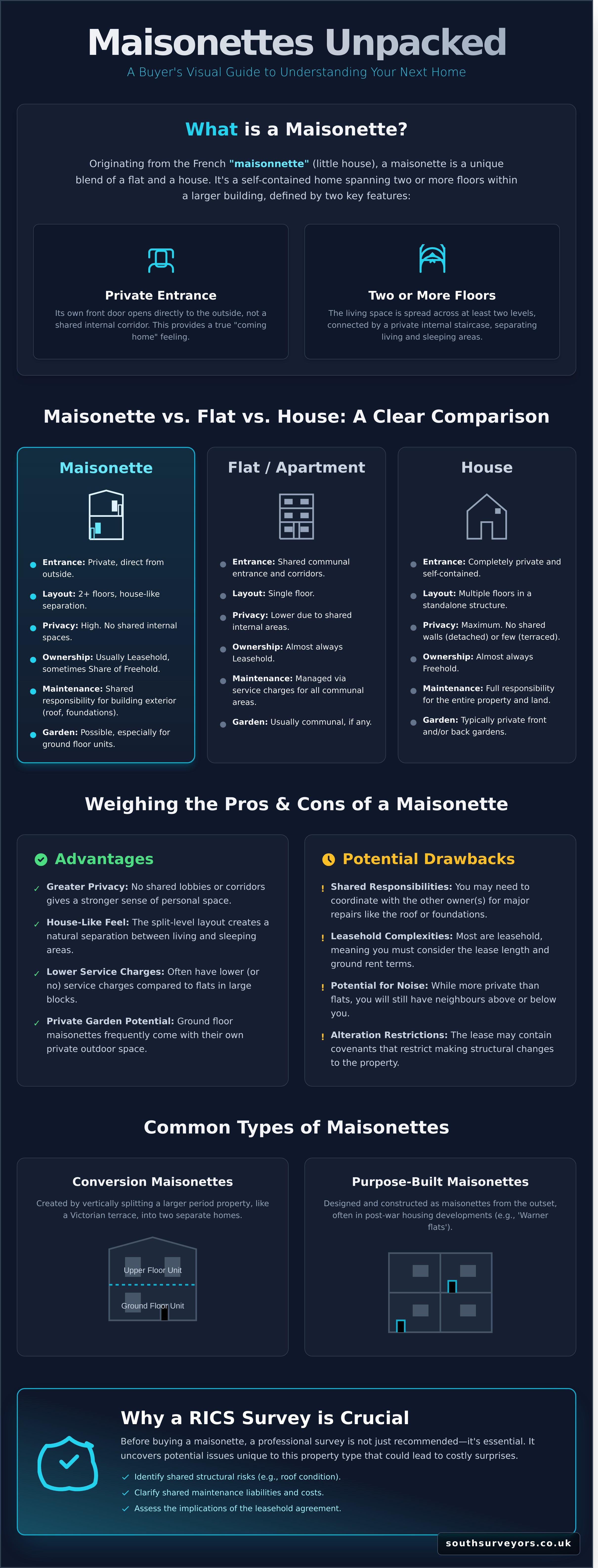

When searching for property in London, you will frequently encounter the term ‘maisonette’. But what exactly is it? In simple terms, a maisonette is a self-contained residential unit that occupies two or more floors of a larger building and, crucially, has its own private entrance opening directly to the outside. The name originates from the French word maisonnette, meaning “little house,” which perfectly captures the unique blend of flat-like living with a house-like sense of independence. To understand exactly what is a maisonette in the context of the UK property market, it is essential to focus on these two defining features.

For a clear visual explanation of the key differences between a maisonette and a flat, this video is a helpful resource:

The Private Entrance Explained

The most significant distinction between a maisonette and a standard flat is the entrance. A flat is typically accessed via a shared internal corridor or communal lobby. In contrast, a maisonette’s front door opens directly to the exterior-be it the street, a private path, or a garden. This feature provides a greater sense of privacy and autonomy, creating the feeling that you are entering your own home rather than just a unit within a larger complex.

Spanning Two or More Floors

The second key characteristic is the internal layout. A maisonette is spread across at least two storeys, connected by a private internal staircase. This multi-floor design allows for a clear separation of living and sleeping areas, similar to a traditional house. For instance, the ground floor might contain the kitchen and living room, with bedrooms located on the floor above. This layout is particularly common in London’s converted Victorian and Edwardian properties, where large houses have been expertly divided into separate dwellings.

Common Types of Maisonettes in London

As a buyer in London, you will primarily encounter two main types of maisonette:

- Conversion Maisonettes: These are the most common type, created by vertically splitting a larger period property, such as a terraced house, into two separate homes. One will typically occupy the ground and first floors (a ground floor maisonette), while the other occupies the upper floors (an upper floor maisonette).

- Purpose-Built Maisonettes: These were designed and constructed specifically as maisonettes, often in post-war housing developments. A well-known London example is the ‘Warner flat’, found predominantly in areas like Walthamstow, which are renowned for their quality build and practical design.

Ground floor versions often come with the significant benefit of a private garden, while upper floor units boast their own staircase from a ground-level front door, providing enhanced privacy and often better natural light.

Maisonette vs Flat vs House: A Clear Comparison for Buyers

When searching for a property in London, the terms ‘flat’ and ‘maisonette’ are often used, but they represent distinct living experiences. Understanding these differences is essential for making an informed decision that aligns with your lifestyle and long-term goals. The distinction in the maisonette vs house debate, for instance, often comes down to ownership structure and private access. This guide provides the clarity you need to navigate your property search with confidence.

To help you quickly assess the key differences, here is a simple comparison table highlighting the practical distinctions that impact daily life and ownership.

| Feature | Maisonette | Flat / Apartment | House |

|---|---|---|---|

| Entrance & Access | Private entrance, direct from the street. No shared internal areas. | Shared building entrance, corridors, and often lifts. | Completely private entrance and self-contained structure. |

| Layout & Floors | Split-level, occupying two or more floors. | Typically all on a single level. | Occupies the entire building across multiple floors. |

| Outdoor Space | Often includes a private garden or a dedicated section of one. | May have a private balcony or access to shared communal gardens. | Almost always includes a private front and/or back garden. |

| Ownership Type | Almost always Leasehold, with a share of the building’s Freehold possible. | Almost always Leasehold. | Typically Freehold, meaning you own the land and building outright. |

Privacy and Access

The most significant advantage of a maisonette is its private entrance. Unlike a flat, you will not share internal corridors, lifts, or a main building lobby. This creates a sense of independence and privacy much closer to that of a house, which offers a completely self-contained structure and exclusive access to the property.

Layout and Living Space

A maisonette is defined by its layout over two or more floors. This split-level design provides a clear separation between living and sleeping areas, often feeling more spacious and house-like than a traditional single-level flat. While a house offers the most potential for space and separation, a maisonette provides a compelling and often more affordable middle ground.

Outdoor Space and Amenities

Private outdoor space is a highly sought-after feature in London. While flats may offer a balcony or access to shared communal gardens, maisonettes frequently come with their own private garden or a clearly demarcated section of a larger one. This is a key benefit that bridges the gap between apartment living and owning a house, which typically includes its own front and back gardens.

The Pros and Cons of Living in a Maisonette

Choosing the right property in London requires a clear understanding of what each type offers. A maisonette can be an excellent choice, but it’s essential to weigh its unique benefits against potential drawbacks. This balanced view will help you move forward with clarity and confidence, ensuring your final decision aligns with your lifestyle, budget, and long-term goals.

Advantages: The Best of Both Worlds?

For many London buyers, a maisonette presents a compelling blend of features, sitting comfortably between a flat and a terraced house. The primary benefits often provide significant value for money and an enhanced living experience:

- Greater Privacy and Autonomy: With your own private entrance directly from the street, you gain a sense of independence and privacy not found in a typical apartment block with shared corridors and lobbies.

- Affordability in Prime Locations: A maisonette often provides more space for your money than a terraced house in the same postcode. This can make desirable London neighbourhoods more accessible, offering a house-like feel without the premium price tag.

- Private Outdoor Space: Many maisonettes, particularly ground-floor ones, come with their own private garden. Upper-floor properties may feature a roof terrace or balcony-a highly sought-after asset in the city.

- Lower Service Charges: As they are typically in smaller converted buildings with fewer shared amenities, service charges are often significantly lower than those in large, managed apartment blocks, reducing ongoing costs.

Disadvantages: What to Watch Out For

While the advantages are significant, it’s crucial to be aware of the potential challenges. A comprehensive property survey can help identify and assess these issues, but prospective buyers should consider:

- Potential for Noise Transfer: As you share a floor or ceiling with another property, there is a risk of noise from your neighbours. The quality of soundproofing can vary greatly between buildings, so this is a key factor to investigate.

- Complex Leasehold Agreements: Most maisonettes are leasehold. This means you must understand the lease terms, including any shared maintenance responsibilities for the building’s structure, such as the roof or foundations. These arrangements can sometimes lead to disputes if not clearly defined.

- Limited Scope for Extension: Unlike a freehold house, your ability to carry out major alterations, such as a loft conversion or rear extension, may be restricted by the terms of your lease and the physical structure of the building.

- Niche Market Position: While popular, maisonettes are less common than purpose-built flats or houses. This can sometimes mean a smaller pool of potential buyers when it comes time to sell, potentially affecting the speed of resale.

Leasehold, Freehold, and Share of Freehold: Understanding Maisonette Ownership

Navigating the ownership structure is arguably the most critical aspect of purchasing a maisonette. Unlike a freehold house, where you own the building and the land it stands on, maisonettes typically involve more complex arrangements. Understanding these terms is essential for making an informed decision and ensuring your long-term peace of mind.

Decoding the Lease Agreement

Most maisonettes in London are sold on a leasehold basis. This means you own the right to occupy the property for a set number of years, as defined in the lease agreement. This legal document is paramount and contains crucial details your solicitor must scrutinise. Key terms include:

- Lease Length: The number of years remaining on the lease. Lenders are often hesitant to offer mortgages on properties with less than 80 years remaining, and extending a short lease can be costly.

- Ground Rent: An annual fee paid to the freeholder (the ultimate owner of the land). While recent legislation has abolished ground rent for new leases, it may still apply to existing ones.

- Service Charges: Payments made towards the upkeep of shared areas and buildings insurance.

- Covenants: Rules and restrictions you must adhere to, such as clauses on keeping pets, making structural alterations, or subletting the property.

Share of Freehold: The Pros and Cons

A ‘Share of Freehold’ is a common and often desirable arrangement for a maisonette. Here, the leaseholders of the building (typically just two parties in a converted house) collectively own the freehold. This offers significant advantages but also comes with unique responsibilities.

Pros:

- Greater Control: You have a direct say in how the building is managed, who carries out repairs, and how much is spent.

- No Ground Rent: As a part-owner of the freehold, you won’t pay ground rent.

- Easier Lease Extensions: You can typically extend your lease to 999 years for a nominal legal fee, avoiding the high costs associated with statutory lease extensions.

Cons:

- Shared Responsibility: All decisions, from minor repairs to major works, require agreement with the other freeholder.

- Potential for Disputes: Disagreements over the cost, necessity, or standard of repairs can lead to conflict if communication is poor.

Who is Responsible for What? (Roof, Foundations, etc.)

The lease agreement is the definitive guide to maintenance responsibilities. It will specify which parts of the building are your sole responsibility (demised premises) and which are shared. A common arrangement is for the upper maisonette to be responsible for the roof and the lower maisonette for the foundations, with costs for shared structures like drains or pathways split equally. A comprehensive RICS survey is vital to assess the condition of these elements before you buy, providing you with the clarity and confidence to proceed. For expert guidance, contact our team at South Surveyors.

Why a RICS Survey is Crucial Before Buying a Maisonette

While a mortgage valuation is a necessity for your lender, it is not a survey. Its purpose is to confirm the property is adequate security for the loan, not to uncover potential defects for you, the buyer. For a property as unique as a maisonette, a comprehensive property survey is an indispensable investment, providing you with the clarity and peace of mind needed to make an informed decision.

Investing in a professional, independent survey can save you from thousands of pounds in unforeseen repair costs and provides a powerful tool for negotiating a better deal. A professional surveyor acts solely in your interest, identifying issues specific to this property type.

Assessing Structural Integrity and Shared Elements

The shared nature of a maisonette’s structure introduces complexities that a surveyor is trained to assess. A thorough inspection will focus on key shared areas to identify current and future liabilities, including:

- The Roof: We check the condition of the roof covering, structure, and drainage, as repairs are often a significant shared expense and a common source of disputes between owners.

- Foundations and Damp: Our surveyors look for signs of subsidence, settlement, and damp which can affect the entire building, not just your unit.

- External Walls and Windows: The state of brickwork, rendering, and window frames are reviewed to assess maintenance requirements you will be responsible for.

Sound Insulation and Fire Safety

Living in close proximity to your neighbours makes soundproofing and fire safety paramount. A surveyor will provide an assessment of the apparent sound insulation between floors and check for compliance with fire safety regulations, such as adequate escape routes and fire separation. These are critical factors for your comfort and safety that are often overlooked during a simple viewing.

Identifying Unauthorised Alterations

Many maisonettes, particularly in converted Victorian or Edwardian buildings, have undergone alterations over the years. A surveyor can often identify structural changes, such as the removal of chimney breasts or walls, that may have been carried out without the necessary freeholder consent or building regulations approval. Such unauthorised work can create legal complications, devalue the property, and even compromise its structural integrity. Don’t leave these critical details to chance. Get clarity and confidence with a survey quote from South Surveyors.

Making Your Informed Maisonette Purchase

A maisonette can be an excellent choice for UK homebuyers, offering a unique blend of the privacy of a house with the convenience of a flat. Understanding the nuances of its ownership structure, whether leasehold or share of freehold, and its potential maintenance responsibilities are the first steps to a successful purchase. However, the most critical step is gaining a professional, impartial assessment of the property’s true condition before you commit.

To proceed with clarity and confidence, a thorough RICS survey is essential. At South Surveyors, our team of local South London experts has extensive experience with conversion properties. As we are regulated by RICS, you are guaranteed the highest professional standards. We deliver clear, detailed reports that empower your property decisions and provide genuine peace of mind, protecting you from unexpected and costly issues down the line.

Don’t leave your investment to chance. Book your RICS Level 2 or Level 3 survey for your maisonette purchase. Armed with the right expert knowledge, you can move forward on your property journey with confidence.

Frequently Asked Questions About Maisonettes

Is a maisonette a good first-time buy?

Yes, a maisonette can be an excellent choice for first-time buyers in London. They often provide more space and privacy than a purpose-built flat, frequently including a private entrance and garden, at a more accessible price than a terraced house. This unique combination offers a ‘house-like’ feel while remaining a more affordable step onto the property ladder. To proceed with confidence, a thorough survey is essential to clarify the property’s condition and any shared maintenance responsibilities.

Are maisonettes harder to get a mortgage on?

Generally, securing a mortgage for a maisonette is no more difficult than for a standard flat. Lenders are primarily concerned with the length of the lease, and a term of 85 years or more is usually acceptable. They will also review the lease covenants to understand maintenance liabilities. While a very short lease can create complications, this is true for any leasehold property. A professional mortgage advisor can offer tailored guidance to ensure a smooth application process.

Who is responsible for the roof and foundations in a maisonette?

Responsibility for structural elements like the roof and foundations is defined entirely by the property’s lease. In a common arrangement, the upper maisonette owner is responsible for the roof, and the lower owner is responsible for the foundations. However, some leases stipulate that all major structural repair costs are shared. It is crucial that your solicitor provides a comprehensive review of the lease to give you complete clarity on your specific obligations.

What is the difference between a maisonette and a coach house?

A maisonette is a self-contained apartment, typically over two floors, with its own front door leading directly outside. It is usually a leasehold property forming part of a larger building. A coach house, in contrast, is a freehold property-a small, standalone house often built above a block of garages that belong to neighbouring homes. The primary distinction is the legal tenure: a coach house is a freehold house, whereas a maisonette is effectively a type of flat.

How does ‘share of freehold’ work with a maisonette?

In a ‘share of freehold’ arrangement, the leaseholders within the building (for instance, the owners of the upper and lower maisonettes) collectively own the freehold title. This gives you greater control over the building’s management, service charges, and lease extensions, removing the need for an external landlord. Decisions regarding maintenance and repairs are made jointly, which requires effective communication and cooperation with your fellow freeholders.

Do you pay ground rent and service charges on a maisonette?

This depends entirely on the legal structure. If the property is leasehold, you will likely pay an annual ground rent, although this is being phased out for new leases under recent legislation. A service charge may also apply if a freeholder or management company looks after communal areas or arranges building insurance. With a ‘share of freehold’ property, you will not pay ground rent but will contribute to a shared fund for maintenance costs as they arise.

Is a maisonette considered a house or a flat for insurance purposes?

For insurance purposes, a maisonette is treated as a flat, not a house. You will require buildings insurance, but how this is arranged is dictated by the lease. In some cases, the freeholder insures the entire building and you reimburse them for your share. In others, the lease may require you to arrange your own policy. Reviewing the lease is the only way to be certain you have the correct and adequate cover in place for your property.