Need a property valuation but concerned about the time and expense of a full physical inspection? In today’s market, speed and cost-effectiveness are key, which is why a professional desktop valuation is often an excellent choice. However, it’s completely understandable to question whether a remote assessment can truly be accurate enough for your important financial decisions, such as for remortgaging or tax purposes.

As RICS-Certified surveyors, our goal is to provide you with clarity and confidence. In this comprehensive guide, we will break down exactly how a desktop valuation works, the reliable data sources we use, and the crucial differences between it and a full inspection. You will leave with a clear understanding of when this service is the most appropriate, efficient, and professional choice, empowering you to make the right decision for your property and your finances.

Defining Desktop Valuations: A Professional Overview

A desktop valuation is a professional property assessment conducted remotely by a qualified RICS surveyor. Unlike a traditional valuation, it does not involve a physical inspection of the property. Instead, the surveyor relies on a comprehensive range of publicly available data, digital information, property records, and market analysis to determine a property’s value. While it uses sophisticated data analysis, a desktop valuation should not be confused with a purely computer-generated Automated Valuation Model (AVM), as it still requires the professional judgment and oversight of an expert surveyor. The primary purpose is to offer a faster, more cost-effective alternative for specific, often lower-risk, scenarios.

To better understand the practical differences, this short video offers a helpful overview:

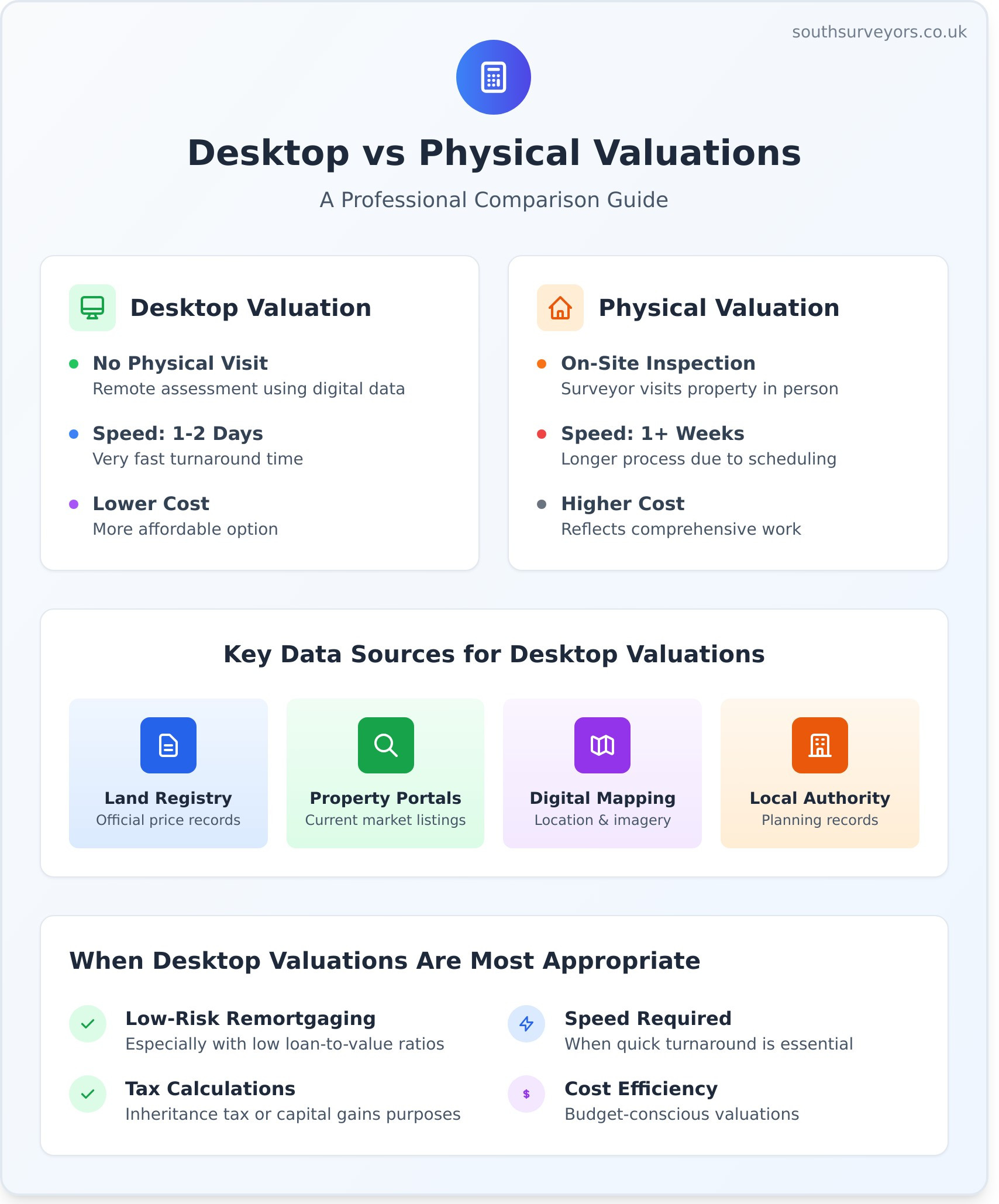

Desktop Valuation vs. Physical Valuation: The Key Differences

Understanding the distinction between these two valuation types is crucial for making an informed decision. The fundamental difference lies in the presence, or absence, of a physical inspection, which has a significant impact on the scope, speed, and cost of the report.

| Feature | Desktop Valuation | Physical Valuation |

|---|---|---|

| Property Inspection | No physical visit is conducted. | A qualified surveyor physically inspects the property. |

| Assessment Basis | Relies on digital data, property records, and market comparisons. | Combines data with an on-site assessment of the property’s condition. |

| Speed | Very fast, typically completed within 1-2 working days. | Slower, often taking a week or more from instruction to report. |

| Cost | More affordable due to reduced time and travel. | More expensive, reflecting the comprehensive on-site work. |

In short, a physical valuation provides a more detailed and nuanced assessment because it accounts for the property’s specific condition, which a remote valuation cannot. However, for many situations, the speed and affordability of a desktop valuation make it the more practical choice.

Why Are Desktop Valuations Used by Lenders and Professionals?

Lenders and other professionals rely on this type of valuation to bring clarity and confidence to transactions where a full physical inspection is not essential. Their use is typically reserved for specific, well-defined circumstances:

- Lower-Risk Scenarios: They are ideal for applications such as remortgaging, especially where the loan-to-value (LTV) ratio is low, indicating significant equity in the property and therefore less risk for the lender.

- Increased Efficiency: The speed of a desktop report allows lenders to process applications much faster, providing a better and quicker service for clients.

- Cost-Effectiveness: By avoiding the time and expense of a site visit, these valuations are a more economical option for both the lender and, in some cases, the borrower.

- Specific Legal or Tax Purposes: They can be sufficient for certain legal matters, such as some inheritance tax (IHT) or capital gains tax calculations, where the property’s internal condition is not the paramount concern.

The Process: How a RICS Surveyor Conducts a Desktop Valuation

A professional desktop valuation is far more than a simple online estimate; it is a meticulous analytical process conducted by a RICS Registered Valuer. This ensures the valuation adheres to the highest industry standards, as mandated by the RICS ‘Red Book’ Global Standards. This framework guarantees a consistent, credible, and transparent approach, combining advanced data analysis with indispensable professional judgment to provide you with a valuation you can trust.

Gathering the Evidence: Key Data Sources

To build a comprehensive picture of the property without a physical inspection, our RICS-certified surveyors draw upon a wide array of reliable, up-to-date data sources. This evidence forms the foundation of the valuation:

- UK Land Registry: We analyse official records for recent and historical sold prices of comparable properties in the immediate vicinity.

- Online Property Portals: Current listings on platforms like Rightmove and Zoopla provide insight into the current asking prices and market sentiment in the area.

- Digital Mapping: Tools such as Google Maps, Street View, and aerial imagery allow for an external assessment of the property’s condition, location, access, and surroundings.

- Local Authority Records: We may consult local planning portals to verify information regarding planning permissions for extensions or significant alterations.

Beyond the Data: The Surveyor’s Expert Analysis

This is where professional expertise transforms raw data into a reliable valuation. Unlike an automated valuation model (AVM) that simply processes algorithms, a RICS surveyor interprets the information. They apply their deep local market knowledge to analyse trends, understand neighbourhood-specific nuances, and make considered adjustments for property type, size, age, and known characteristics. This expert layer of analysis is what provides the accuracy and confidence a purely automated system cannot match.

What You Receive: The Final Valuation Report

Upon completion, you receive a formal, professional report that clearly states the property’s current market value. The document will summarise the evidence considered and outline the key assumptions made during the valuation process. Crucially, the report is signed by a RICS Registered Valuer, giving it the professional standing required for legal and financial purposes. This provides you with the clarity and peace of mind needed to make your next move. Need a reliable valuation? Contact our RICS-certified team.

When is a Desktop Valuation Appropriate? Common Use Cases

A desktop valuation provides a professional, RICS-regulated market value without the need for a physical inspection. This makes it an ideal and cost-effective solution for low-risk scenarios where the property is of standard construction and its internal condition is not a primary concern. Understanding when this service is most suitable will provide you with the clarity and confidence to make an informed decision.

This type of report is frequently used in situations where an accurate, impartial market value is required for financial, legal, or administrative purposes. Below are some of the most common applications.

Valuations for Mortgages and Lending

Lenders often use automated or desktop-based models for low-risk borrowing. If you have substantial equity in your property, the lender’s exposure is reduced, making an in-person visit less critical. Common scenarios include:

- Remortgaging: Particularly when you are not borrowing a significant additional amount and have a low Loan-to-Value (LTV) ratio.

- Further Advances: For smaller second-charge loans or when releasing a modest amount of equity from your home.

- Buy-to-Let Mortgages: Some lenders will accept a desktop valuation for standard buy-to-let properties, especially for portfolio landlords or straightforward remortgages.

Legal and Tax-Related Valuations

For many official proceedings, what’s required is a definitive, evidence-based valuation report that complies with legal and HMRC standards. The focus is on the market value at a specific date, not a detailed condition survey. This includes:

- Inheritance Tax (Probate): Establishing the value of a property as part of an estate for probate purposes.

- Capital Gains Tax: Calculating the property’s value at the time of sale or acquisition to determine tax liability.

- Matrimonial Proceedings: Providing an independent valuation for the division of assets or a transfer of equity.

Shared Ownership and Help to Buy

Government-backed housing schemes have specific requirements for valuations, which must be carried out by an RICS Registered Valuer. A desktop report is often a perfect fit, offering a compliant and efficient service for:

- Staircasing: When you need to value your home before purchasing additional shares in your shared ownership property.

- Selling: To set the correct market value as required by your housing association before you can sell.

- Help to Buy Loan Redemption: To determine the current market value when you are ready to repay your Help to Buy equity loan.

The Limitations: When You Absolutely Need a Physical Inspection

While a desktop valuation offers a fast and cost-effective estimate, its accuracy is built on a crucial assumption: that the property is in a reasonable, well-maintained condition. As RICS-Certified professionals, our priority is to provide you with the clarity and confidence needed to make a sound financial decision. This means being transparent about when a remote assessment is not enough.

A property’s true value can be significantly impacted by hidden defects that no algorithm or online data can detect. For complete peace of mind, especially during a purchase, a thorough physical inspection by a qualified surveyor is the only way to uncover the full picture and avoid potentially costly surprises down the line.

Red Flags: Property Characteristics

Certain types of properties carry a higher risk of underlying issues that a remote valuation cannot account for. An in-person inspection is strongly recommended if the property is:

- Older (e.g., pre-1950): These homes may have issues common to their age, such as damp, outdated electrical systems, or historic structural movement that require an expert eye.

- Significantly extended or altered: Without a physical check, it’s impossible to assess the quality of workmanship or whether alterations comply with building regulations.

- Of unusual construction: Properties built with non-standard materials like a timber frame or concrete require specialist knowledge to value correctly and assess for specific defects.

- A listed building or in a conservation area: These properties are subject to strict regulations, and any necessary repairs can be exceptionally expensive, a factor that must be included in an accurate valuation.

Red Flags: Transaction Types

The nature of the transaction itself often dictates the need for a more comprehensive assessment. A physical survey is essential in the following scenarios:

- When purchasing a property: This is likely your largest investment. A surveyor acts as your eyes and ears, identifying defects that can protect you from unforeseen repair costs running into thousands of pounds.

- For high-value properties: When dealing with substantial sums, even a small percentage error in a valuation can represent a significant amount of money. A £1,000,000 property with a 5% valuation error is a £50,000 discrepancy.

- If you need to negotiate the price: A detailed survey report provides you with factual evidence of repair costs, giving you a powerful tool to negotiate a fairer purchase price with the seller.

Ultimately, if you have any doubts about a property’s condition, a physical inspection is the most reliable way to proceed with real confidence. To understand which survey is right for your needs, you can explore our RICS Home Survey services and ensure you are fully informed.

Desktop Valuations vs. AVMs vs. Estate Agent Appraisals

Navigating the world of property values can be confusing, with several terms often used interchangeably. However, a professional desktop valuation, an Automated Valuation Model (AVM), and an estate agent’s appraisal are fundamentally different. Understanding these differences is crucial for making informed decisions with clarity and confidence.

Desktop Valuation vs. Automated Valuation Model (AVM)

An AVM is a computer-generated estimate, the kind you often see on property portals or mortgage calculator sites. It uses a pure algorithm to analyse historical sales data and local trends. While fast and free, it lacks human oversight. In contrast, a professional desktop valuation is conducted by a RICS-certified surveyor who expertly interprets this data, considering nuances an algorithm would miss. Crucially, a formal valuation is backed by professional indemnity insurance, offering a level of security and peace of mind that a free online estimate cannot provide.

Desktop Valuation vs. Estate Agent ‘Valuation’

It’s important to recognise that an estate agent provides a ‘market appraisal’, not a formal valuation. This is a marketing tool designed to win your instruction to sell the property. The figure can be optimistic and is not an impartial assessment of value. A RICS desktop valuation, however, is a formal, unbiased report that adheres to strict professional standards. It is a legally recognised document suitable for official matters like probate or tax calculations, whereas an agent’s opinion holds no legal weight.

| Factor | Desktop Valuation | Automated Valuation Model (AVM) | Estate Agent Appraisal |

|---|---|---|---|

| Cost | Modest Fee (e.g., £150 – £300) | Free or minimal cost | Free |

| Accuracy | High (Expert surveyor analysis) | Low to Moderate (Algorithmic only) | Variable (Marketing-led figure) |

| Purpose | Formal use (tax, legal, probate) | Informal, initial estimate | Guide for setting an asking price |

| Professional Standing | Regulated by RICS, fully insured | None | None (Not a formal valuation) |

Ultimately, while free estimates have their place for a quick snapshot, they lack the rigour, accountability, and impartiality of a report from a qualified professional. For a valuation you can truly rely on for important financial decisions, speak with a RICS-certified surveyor.

Desktop Valuation: Your Path to Clarity and Confidence

Understanding your property valuation options is the key to making an informed decision with confidence. As we’ve detailed, a desktop valuation provides a swift, cost-effective, and professional assessment from a RICS surveyor, ideal for situations like refinancing or initial portfolio reviews. However, its true value lies in knowing when to use it; it is not a substitute for a full physical inspection when the property’s condition is a critical factor. This expert judgement is what distinguishes a surveyor-led valuation from a simple automated model or an estate agent’s appraisal.

When you need a reliable report grounded in professional standards, our team is here to provide clarity. Regulated by RICS and leveraging expert local knowledge across South London, we deliver professional, clear, and reliable reports you can trust. Move forward with your property decisions with complete peace of mind. Request a quote for your RICS Property Valuation today.

Frequently Asked Questions About Desktop Valuations

How accurate is a desktop valuation?

A desktop valuation provides a reliable estimate, but its accuracy is entirely dependent on the quality and availability of public data. It uses algorithms, property records, and recent local sales data. However, it cannot account for a property’s internal condition, recent high-spec renovations, or unique features. For a more definitive figure that provides complete clarity and confidence, an in-person valuation by a RICS-Certified surveyor remains the most thorough and reliable option.

How long does a desktop valuation take and how much does it cost?

One of the primary benefits is speed and affordability. The process is typically completed within one to two business days, as no physical site visit is required. Costs are significantly lower than a full RICS valuation, often ranging from £75 to £200 in the UK. This makes it a cost-effective choice for initial assessments, such as for remortgaging or portfolio reviews, where a quick, expert opinion is needed without the expense of a full inspection.

Can I use a desktop valuation for my mortgage application?

Whether a lender accepts a desktop valuation depends on their specific criteria and the loan-to-value (LTV) ratio. For lower-risk lending, such as remortgages with a low LTV, many UK lenders now accept them. However, for new purchases, especially for higher LTV mortgages or non-standard properties, most lenders will still insist on a more comprehensive physical valuation to ensure their investment is secure. We always advise checking directly with your lender to confirm their requirements.

What if I disagree with the final figure in a desktop valuation?

If you believe the valuation figure is inaccurate, you can submit an appeal. This typically involves providing new evidence to the valuer, such as details of recent, comparable property sales they may have missed, or proof of significant home improvements not visible in public data. A professional, RICS-regulated firm will have a clear appeals process to ensure your query is handled fairly and transparently, giving you confidence in the final outcome.

Does a desktop valuation report on the condition of the property?

No, a key limitation of a desktop valuation is that it does not include any assessment of the property’s physical condition. The valuation is based solely on data and does not involve an inspection. It cannot identify potential defects like damp, structural issues, or the state of the roof. For a thorough report on the property’s condition and potential repair costs, you would need to commission a RICS Home Survey Level 2 or Level 3.

Is a desktop valuation the same as a RICS Home Survey?

No, they are fundamentally different services for different purposes. A desktop valuation provides an estimate of a property’s market value without an inspection. In contrast, a RICS Home Survey is a comprehensive, in-person inspection of the property’s physical condition, designed to identify defects and advise on necessary repairs. A survey provides the critical insight needed for an informed purchase, while a valuation is primarily for financial lending purposes.