Navigating the world of property valuations can often feel complex and uncertain. You may be wondering if a modern desktop valuation offers the accuracy you require, or if a traditional in-person inspection is essential for your circumstances. With industry jargon like ‘AVM’ and ‘Red Book’ adding to the confusion, the fear of paying for the wrong service is a very real concern for many property owners and buyers across the UK.

As RICS-Certified professionals, our goal is to provide you with clarity and confidence. In this comprehensive guide, we demystify the process, breaking down the crucial differences between a remote desktop valuation and a physical, in-person assessment. We’ll explore the key benefits and limitations of each, ensuring you have the expert knowledge to choose the most appropriate and cost-effective report. Our aim is to empower you to fulfil your legal or lender requirements with complete peace of mind, knowing your decision is both informed and reliable.

What is a Desktop Valuation? The Fundamentals Explained

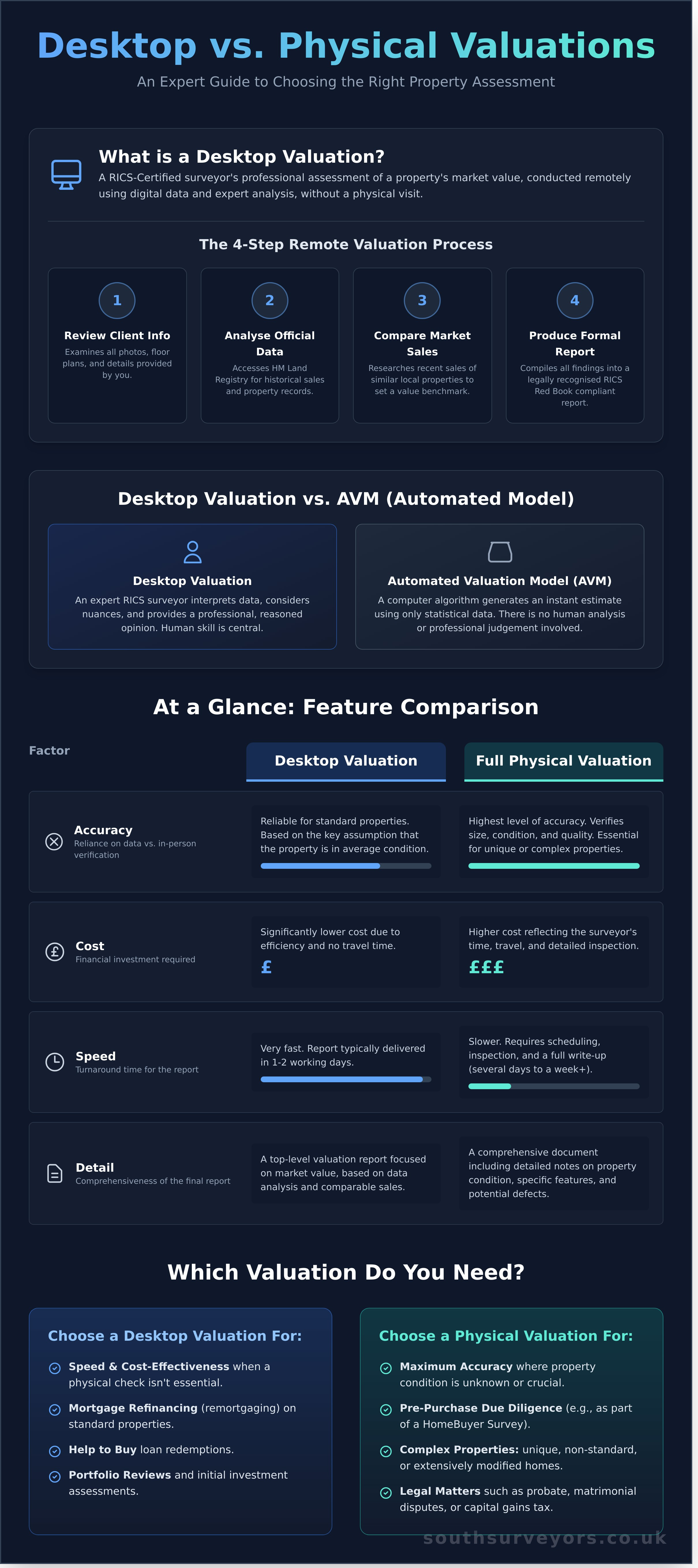

A desktop valuation is a professional assessment of a property’s market value, conducted by a RICS-Certified surveyor entirely from their desk. Unlike a traditional valuation, which involves a comprehensive physical inspection of the property, this remote method relies on a wealth of digital information to provide a reliable and expert opinion on value.

This approach provides a faster and more cost-effective alternative when a full in-person visit isn’t necessary. To better understand this concept, watch this helpful overview:

It is crucial to understand that a professional desktop valuation is not the same as the free, instant estimates provided by property portals like Zoopla or Rightmove. Those are automated calculations, whereas this is a tailored report produced with the expert analysis and professional indemnity of a qualified surveyor, giving you clarity and real confidence in the figure provided.

The Process: How a Surveyor Values Your Property Remotely

To ensure accuracy without a physical visit, a RICS surveyor undertakes a thorough and methodical process. This expert assessment is based on a combination of data sources and professional judgement:

- Review of Provided Information: The surveyor carefully examines any information, photographs, or floor plans supplied by the client.

- Official Data Analysis: They access and analyse official records from sources like HM Land Registry, including historical sales data for the property and the surrounding area.

- Comparable Market Evidence: The surveyor researches recent sales of similar properties (comparables) in the local market to establish a current value benchmark.

- Formal Report Production: The findings are compiled into a formal, RICS Red Book compliant valuation report, which is a legally recognised document suitable for a range of purposes.

Desktop Valuation vs. Automated Valuation Model (AVM)

While both are remote, a key distinction exists between a desktop valuation and an Automated Valuation Model (AVM). An AVM is a purely computer-driven algorithm that generates an estimate using statistical data, with no human oversight. These are often used by mortgage lenders for low-risk scenarios like remortgaging. In contrast, a desktop valuation involves the professional skill and judgement of a RICS surveyor who interprets the data, considers the property’s specific nuances, and provides a considered, expert opinion. This human element offers a significantly higher level of assurance than a purely automated estimate.

Key Differences: Desktop Valuation vs. Full Physical Valuation

Choosing between a desktop valuation and a full physical valuation comes down to a simple trade-off: speed and cost versus accuracy and detail. While both are performed by RICS-Certified professionals, they serve distinct purposes. Understanding these core differences is the first step toward making an informed decision that provides clarity and confidence in your property’s value.

To provide a clear overview, here is a direct comparison of the key factors:

| Factor | Desktop Valuation | Full Physical Valuation |

|---|---|---|

| Accuracy | Reliable for standard properties in data-rich areas. Based on assumptions about condition. | Highest level of accuracy. Verifies condition, size, and quality in person. Essential for unique properties. |

| Cost | Significantly lower cost. | Higher cost due to time, travel, and detailed inspection. |

| Speed | Very fast, typically delivered in 1-2 working days. | Slower process, requiring scheduling and a comprehensive report write-up (days to over a week). |

| Detail | A top-level report based on data analysis and comparable sales. | A comprehensive, detailed report including notes on property condition, defects, and specific features. |

| Common Use Cases | Mortgage refinancing, portfolio reviews, initial assessments, and Help to Buy redemptions. | Pre-purchase due diligence (surveys), probate, matrimonial disputes, and complex property assessments. |

Methodology: Data Analysis vs. Physical Inspection

A desktop valuation relies entirely on existing information. Our expert surveyors analyse public records, recent comparable sales data, and powerful statistical models to determine value remotely. In contrast, a full physical valuation includes a thorough on-site inspection. This allows a surveyor to identify crucial details like the property’s specific condition, undocumented extensions, or potential defects that are impossible to see in any database.

Accuracy and Reliability: What are the Limitations?

The reliability of a valuation method depends heavily on the property itself. For standard-build homes in areas with abundant sales data, a remote report can be highly accurate. However, its accuracy diminishes for unique, non-standard, or extensively modified properties. A full physical valuation is far more reliable in these cases, as it verifies the true size, quality, and condition, removing the critical assumptions inherent in a remote assessment.

Cost and Speed: The Primary Advantages of a Desktop Report

The key benefits of a desktop approach are efficiency and affordability. With no site visit required, reports are delivered much faster-often within one or two working days. This also significantly reduces the cost. In the London area, a professional desktop valuation might cost between £150 – £300, whereas a full physical valuation for a standard property generally starts from £500 – £900 and can increase depending on its size and complexity.

When is a Desktop Valuation the Right Choice? (Common Use Cases)

While an in-person inspection provides the most detailed analysis, a desktop valuation is an expert, cost-effective, and RICS-compliant solution perfectly suited to specific, lower-risk scenarios. It provides the clarity and confidence you need when the property’s general condition is already known or when a full physical inspection is not a primary requirement. Understanding these common use cases helps you determine if this efficient service is the right choice for your needs.

Our RICS-Certified surveyors provide reliable reports for a range of circumstances, ensuring you meet legal and financial obligations without unnecessary expense. Below are the most frequent situations where a desktop valuation is the ideal professional tool.

Valuations for Lenders and Remortgaging

Lenders frequently rely on this type of valuation to manage risk efficiently. It is particularly common for low Loan-to-Value (LTV) mortgage applications, where the loan amount is small relative to the property’s value. It is also a standard and speedy process when remortgaging a standard property, especially with your existing lender, as it allows them to quickly verify the collateral value and proceed with confidence.

Help to Buy and Shared Ownership Valuations

If you are redeeming your Help to Buy loan or ‘staircasing’ (buying more shares in your Shared Ownership property), you will need a formal valuation. A desktop report is often the most suitable option, providing a fast and affordable way to obtain the required RICS valuation. These reports are structured to meet the specific criteria set by Target HCA and other housing associations, ensuring a smooth and compliant process.

Legal and Tax Purposes (Probate, Capital Gains)

For many official financial calculations, a formal property valuation is required by HMRC. A desktop valuation provides the necessary impartial evidence for situations such as:

- Probate: Calculating Inheritance Tax liabilities as part of administering an estate.

- Capital Gains Tax: Determining the tax owed when selling a second home or investment property.

This provides an official, RICS-regulated figure that satisfies legal requirements in a timely and economical manner.

When a Physical Valuation is Non-Negotiable

While desktop valuations offer speed and convenience for specific purposes like refinancing, it’s crucial to recognise their limitations. At South Surveyors, our commitment is to provide you with clarity and confidence. In certain high-stakes scenarios, relying solely on algorithms and data is insufficient. Investing in a physical, in-person valuation by a RICS-Certified surveyor isn’t an expense; it’s an investment in certainty and security for your property transaction.

Unique, Older, or High-Value Properties

Properties with unique characteristics demand an expert eye on-site. This includes listed buildings with strict heritage constraints, homes with non-standard construction (such as timber frames or cob walls), or older properties where hidden defects like subsidence or outdated wiring may not be apparent from data alone. For high-value assets, the financial risk is simply too great to rely on a remote assessment. A physical inspection is essential to provide a thorough and reliable valuation.

Properties with Known Issues or Recent Extensions

If you already have concerns about a property’s condition-perhaps you’ve noticed cracks, signs of damp, or an ageing roof-a physical inspection is the only way to investigate properly. A desktop valuation cannot assess the quality of workmanship on a recent extension or loft conversion, nor can it determine the severity of a structural issue. An on-site visit allows a surveyor to evaluate these elements in detail, giving you a true picture of the property’s state. Concerned about a property’s condition? A Level 2 or 3 Survey may be better.

When Making a Purchase Decision

It is vital for homebuyers to understand that a lender’s valuation is not a survey. Its purpose is to protect the lender’s investment, not yours. When you are buying a home, a physical inspection is non-negotiable for several key reasons:

- It uncovers potential costs: A surveyor will identify defects that could lead to thousands of pounds in unforeseen repair bills.

- It provides negotiating power: A detailed report can be a powerful tool for negotiating a better purchase price with the seller.

- It offers peace of mind: A remote desktop valuation provides no protection against discovering problems after you’ve moved in. A RICS Home Survey gives you a comprehensive understanding of what you are buying.

Ultimately, for the most important purchase of your life, an in-person assessment by a qualified professional provides the assurance you need to make an informed decision. For more information, please contact our expert team.

The Role of RICS: Ensuring Professional Standards in All Valuations

When deciding between different types of property valuations, the most critical factor is not just the method used, but the professional standards governing it. Whether you opt for an in-person inspection or a remote desktop valuation, the report must be underpinned by expertise, ethics, and accountability. This is where the Royal Institution of Chartered Surveyors (RICS) plays a vital role, providing the framework that guarantees quality and gives you complete peace of mind.

At South Surveyors, our commitment to these standards is unwavering. Every valuation we conduct is performed by a RICS Registered Valuer, ensuring you receive a reliable and professional assessment that you can trust for your financial decisions.

What is the RICS ‘Red Book’?

The cornerstone of professional valuation standards in the UK is the RICS Valuation – Global Standards, commonly known as the ‘Red Book’. This isn’t just a guide; it is a rulebook containing mandatory practices for all RICS Registered Valuers. Its purpose is to ensure every valuation is prepared to the highest professional and ethical standards.

- Mandatory Rules: The Red Book sets out clear and non-negotiable rules for conducting valuations, ensuring a consistent and high-quality approach every time.

- Impartiality and Transparency: It guarantees that valuations are objective, independent, and transparent, removing any potential for bias.

- Universal Application: These rigorous standards apply to all forms of valuation, from a comprehensive physical inspection to a data-driven desktop valuation.

- Official Recognition: A Red Book valuation is a mark of quality and trust, recognised as the gold standard by lenders, courts, and government bodies like HMRC.

Why Choose a RICS Registered Valuer?

Choosing a RICS Registered Valuer provides a level of assurance that is unmatched in the industry. It is your guarantee that the professional handling your valuation is not only qualified but also strictly regulated. This commitment to excellence provides you with the clarity and confidence needed to move forward.

A RICS valuation delivers:

- Proven Expertise: Valuers must have the required qualifications, skills, and practical experience to become RICS registered.

- Strict Ethical Conduct: They are bound by a stringent code of conduct, prioritising integrity and client interest above all else.

- Credibility and Peace of Mind: The RICS designation provides an instant mark of credibility, assuring you that your property’s value has been assessed accurately and professionally.

Ultimately, the RICS framework ensures your property valuation is robust, reliable, and respected. All our valuations are conducted by RICS Registered Valuers. Get your quote today.

Making the Right Valuation Choice with Confidence

Navigating property assessments comes down to selecting the right tool for your specific situation. The key takeaway is that while a full physical valuation is essential for complex purchases or when property condition is a factor, a desktop valuation offers a highly efficient and reliable solution for many other scenarios, including remortgaging and portfolio reviews. Understanding this distinction is the first step toward making a sound, informed financial decision.

Ultimately, whether remote or in-person, a valuation must inspire trust. As a firm proudly Regulated by RICS, South Surveyors is committed to providing that certainty. We combine our deep, local South London expertise with the industry’s highest professional standards to deliver clear, comprehensive reports that give you genuine peace of mind. We ensure you have the expert guidance needed to move forward with your property goals.

Ready to proceed with clarity? Get a clear, RICS-compliant property valuation from our experts.

Frequently Asked Questions About Desktop Valuations

How accurate is a RICS desktop valuation compared to a free online estimator?

A RICS desktop valuation is significantly more reliable than a free online estimator. While online tools use automated algorithms, a RICS valuation is a professional assessment conducted by a qualified surveyor. They use comprehensive, up-to-date data from sources like the Land Registry and analyse recent comparable sales to provide an expert opinion of market value. This delivers a level of accuracy and confidence that automated estimators simply cannot match, giving you a trustworthy figure for your property decisions.

Can I use a desktop valuation for my initial mortgage application?

In many cases, yes. Lenders frequently accept a desktop valuation for lower-risk scenarios, such as remortgaging or applications with a low loan-to-value (LTV) ratio. However, for more complex situations like purchasing a unique property or applying for a high LTV mortgage, they will almost always require a full, in-person valuation. We always recommend checking your specific lender’s criteria to ensure you have the correct report for your application and can proceed with clarity.

Does a desktop valuation report tell me about the property’s condition?

It is crucial to understand that a desktop valuation report does not assess the property’s physical condition. Its sole purpose is to determine the market value based on available data, without an in-person inspection. To gain clarity on the building’s structural integrity, identify potential defects, and understand future repair costs, you will need a separate RICS property survey, such as a HomeBuyer Report or a comprehensive Building Survey. This ensures you make a fully informed decision.

How long does a desktop valuation take and how long is the report valid for?

A key advantage of a desktop valuation is its speed; the process is typically completed within one to two working days because no site visit is required. Once issued, the valuation report is generally considered valid by lenders for three months. This timeframe reflects the dynamic nature of the UK property market, as fluctuations can impact a property’s value. If your transaction takes longer, a new valuation may be required to ensure the figure remains current and reliable.

What happens if the desktop valuation comes in lower than expected?

If the valuation is lower than your agreed purchase price, this is known as a ‘down-valuation’. This means the mortgage lender will base their loan offer on the lower valuation figure, creating a shortfall you would need to cover with a larger deposit. Your options include trying to renegotiate the price with the seller, challenging the valuation with compelling evidence of higher-priced comparable properties, or seeking a new mortgage application with a different lender who may instruct another valuer.

Why would a mortgage lender insist on a full, in-person valuation instead?

Lenders insist on a full, in-person valuation to mitigate their lending risk, especially in more complex cases. A physical inspection is necessary for properties that are of non-standard construction, are particularly old, have been significantly altered, or are in an area with known issues like subsidence. It allows a surveyor to identify defects or characteristics not visible in data alone, giving the lender the detailed assurance they need before approving a significant loan against the property.