RICS HomeBuyer Report: A Complete Guide for 2025

Buying a property is one of life’s biggest investments, but it can also be filled with uncertainty. Are you worried about hidden defects that could lead to unexpected and costly repairs? Perhaps you’re unsure which survey is right for your property or if the expense is truly justified. This is where a professional rics homebuyer report provides essential clarity and confidence. As a comprehensive and expert assessment, it is designed to give you a clear understanding of a property’s condition without overwhelming you with technical jargon, offering the peace of mind you need to move forward.

In this complete guide for 2025, we will demystify the RICS HomeBuyer Report (also known as a Level 2 Survey). You will learn exactly what is inspected, how to interpret the findings, and when this survey is the most suitable choice for a property. Our goal is to empower you with the reliable information needed to negotiate a better price, budget for any necessary work, and ultimately, make a confident and informed decision about your purchase. Let’s ensure your investment is a sound one.

What is a RICS HomeBuyer Report (Level 2 Survey)?

The RICS HomeBuyer Report, also known as a Level 2 Survey, is the most popular property survey in the UK for conventional homes in a reasonable state of repair. Its primary goal is to provide you with a clear, expert assessment of a property’s condition, identifying any significant issues or defects before you commit to the purchase. This is a standardised report format created by the Royal Institution of Chartered Surveyors (RICS) and carried out by a qualified Chartered Surveyor, ensuring you receive a professional and easy-to-understand evaluation.

To give you a clearer picture of the different survey levels available, this short video provides an excellent overview:

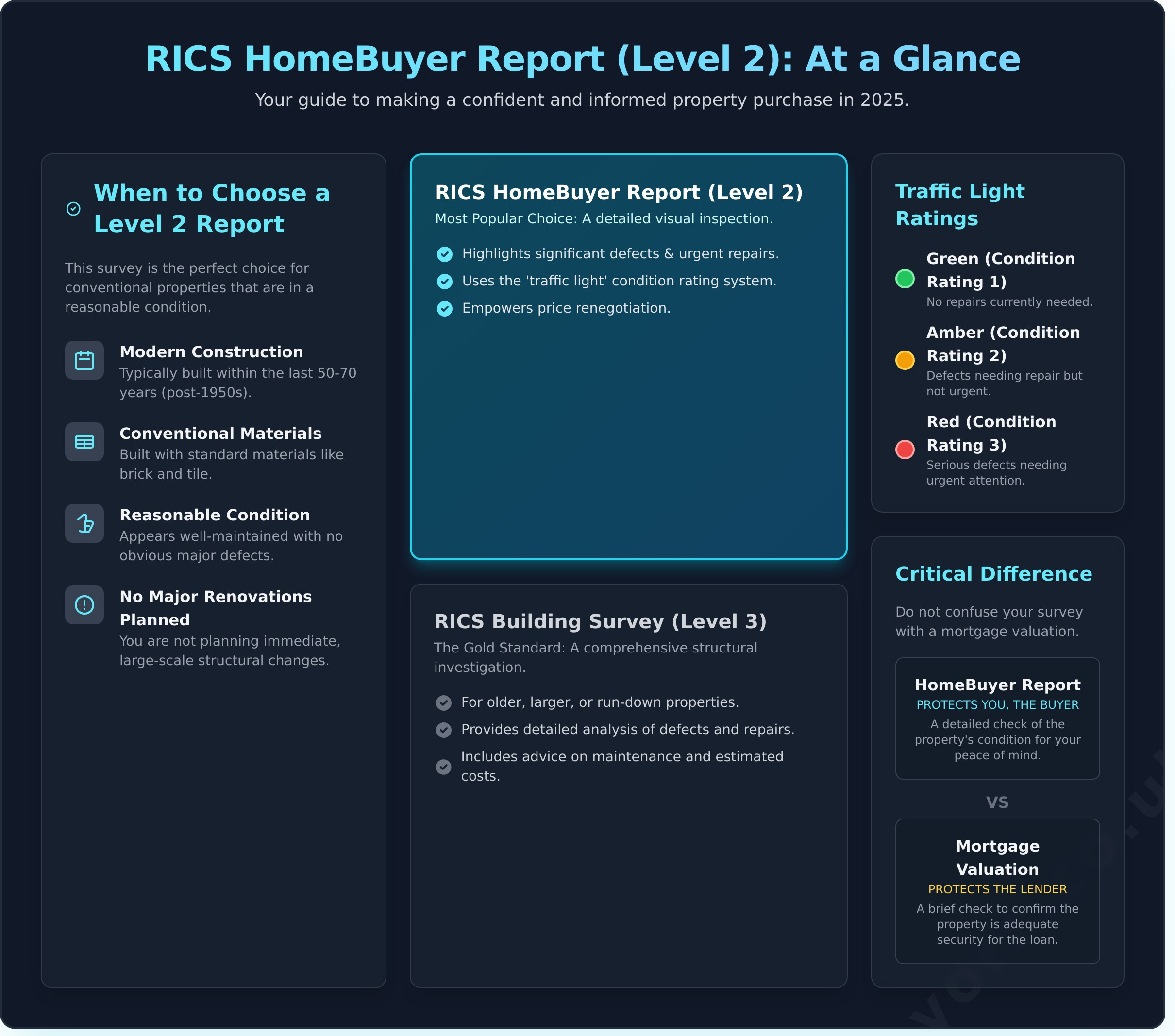

A key feature of the HomeBuyer Report is the straightforward ‘traffic light’ condition rating system. Each aspect of the property is rated green (no repairs needed), amber (requires repair but not urgent), or red (serious defects needing urgent attention). This provides an at-a-glance summary, helping you quickly identify the most critical issues and giving you real confidence in your decision.

The Purpose: Your Pre-Purchase Health Check

Investing in a survey is an essential step in protecting what is likely your largest financial commitment. The report moves beyond the surface-level impression from a viewing, offering a thorough inspection to uncover hidden problems. This professional insight is designed to provide complete clarity and peace of mind.

- It provides an expert assessment of the property’s overall condition.

- It flags urgent defects and potential risks that could lead to unforeseen repair costs.

- It empowers you with the detailed information needed to make a fully informed decision.

- It can serve as a powerful, evidence-based tool for renegotiating the purchase price.

HomeBuyer Report vs. Mortgage Valuation: A Critical Difference

It is vital not to confuse a rics homebuyer report with the mortgage valuation required by your lender. A mortgage valuation is a brief assessment conducted for the lender’s benefit, confirming only that the property is adequate security for the loan. It is not a detailed survey and will not highlight most repair needs.

In contrast, the HomeBuyer Report is commissioned by you, the buyer, to protect your interests. Its sole purpose is to give you a comprehensive understanding of the property’s state of repair. Relying only on a mortgage valuation is a significant risk that can lead to discovering costly structural issues, damp, or other problems after you have already completed the purchase.

When is a HomeBuyer Report the Right Choice for You?

Selecting the correct property survey is a critical step in your home-buying journey, providing the clarity and confidence needed to proceed. While the RICS HomeBuyer Report (also known as a RICS Home Survey Level 2) is the most popular choice for UK buyers, it’s essential to ensure it aligns with the specific property you intend to purchase. This ensures you get the right level of detail without paying for information you don’t need.

This comprehensive report is designed to give you a clear, expert assessment of a property’s condition, but it is most effective when used for the right type of home.

Profile of the Ideal Property

The Level 2 survey is expertly designed for properties that are generally in good condition and of a standard construction type. It’s the perfect choice if the home you are considering matches the following profile:

- Modern Construction: Typically built within the last 50-70 years, often post-1950s.

- Conventional Materials: Constructed from common, standard materials like brick walls and a tiled roof.

- Reasonable Condition: The property appears to have been reasonably well-maintained, with no obvious major structural defects.

- No Major Plans: You are not planning immediate, large-scale renovations, extensions, or significant structural changes.

If the property is very old, a listed building, has an unusual structure (such as a timber frame or thatched roof), or is visibly in a poor state of repair, a Level 2 survey may not provide the depth of information you require.

Comparing Survey Levels: Level 2 vs. Level 3

Understanding the key differences between survey levels is vital for making an informed decision. Choosing the right one prevents you from either being underinformed about serious risks or overpaying for a survey that is too detailed for your needs.

The rics homebuyer report (Level 2) offers a thorough visual inspection, highlighting significant defects and urgent repairs using a clear ‘traffic light’ rating system. It delivers the professional advice you need for a standard property.

In contrast, a RICS Building Survey (Level 3) is a much more in-depth investigation. It is the gold standard for older, larger, or run-down properties. This survey provides a detailed structural analysis, a breakdown of the building’s fabric, and comprehensive advice on defects, repairs, and maintenance, often including estimated costs. Matching the survey to the property’s age and condition is the surest way to achieve complete peace of mind.

What’s Inside the Report? A Section-by-Section Breakdown

Understanding what you’re getting is key to making an informed decision. The RICS HomeBuyer Report is designed for clarity and confidence, presenting our expert findings in a clear, standardised format. This structure ensures you can easily navigate the surveyor’s assessment and quickly identify the most critical information about your potential new home.

Decoding the ‘Traffic Light’ Condition Ratings

At the heart of the report is the simple yet effective ‘traffic light’ system. This helps you instantly see which issues require your attention. Each element of the property is assigned a rating to provide a clear, at-a-glance summary of its condition.

- Condition Rating 1 (Green): No repair is currently needed. The element is in good condition and simply requires normal maintenance.

- Condition Rating 2 (Amber): Defects are present that need repairing or replacing, but are not considered urgent. Think of a dripping tap or a stiff window lock.

- Condition Rating 3 (Red): These are serious defects demanding urgent repair, replacement, or further investigation. A leaking roof, significant structural cracking, or widespread damp would fall into this category.

Key Areas of Inspection: What We Look For

Our RICS-certified surveyors conduct a thorough, non-invasive visual inspection of the property’s main components. A comprehensive rics homebuyer report will provide a detailed summary of key areas, including:

- Roof and Chimneys: We look for signs of leaks, damaged tiles, and the general condition of the structure.

- Walls and Foundations: Our surveyors check for evidence of damp, subsidence, or structural movement.

- Windows and Doors: We assess their general condition, functionality, and the state of glazing.

- Services: A visual check of the plumbing, heating, and electrical installations is performed to identify any obvious defects or safety concerns.

Beyond Defects: Advice for Your Solicitor

A crucial section of the report provides specific advice for your legal advisers. This part bridges the gap between the physical survey and the legal conveyancing process. Our surveyor will highlight potential issues that require further investigation, such as evidence of extensions that may lack planning permission or unclear boundary lines. This professional guidance helps ensure you are making a fully informed decision, both structurally and legally.

How to Use Your Report for Maximum Advantage

Receiving your RICS HomeBuyer Report is a pivotal moment in your property purchase. It’s far more than a list of potential problems; it is a powerful tool designed to give you clarity and control. By understanding how to leverage the information within, you can negotiate from a position of strength, plan for the future, and make your final decision with complete confidence.

One of the most valuable aspects of the report is the professional insight it provides. We always recommend a follow-up call with your RICS-Certified surveyor to discuss the findings. They can add crucial context to the written points, helping you fully grasp the implications and prioritise your next steps.

Renegotiating the Purchase Price

The report’s ‘Condition Rating 3’ (Red) defects are serious issues that require urgent repair. These findings provide a solid, evidence-based platform for negotiation. To use this effectively:

- Obtain at least two written quotes from qualified tradespeople for the repair work identified.

- Present these professional estimates to the seller’s estate agent as a factual basis for reducing your offer.

An investment of a few hundred pounds in a thorough survey can frequently save you thousands on the purchase price or in unforeseen repair costs. This step alone often makes the report one of the wisest financial decisions you’ll make. Get a quote for a HomeBuyer Report today.

Planning for Future Repairs and Maintenance

A smart homeowner is a prepared homeowner. The report’s ‘Condition Rating 2’ (Amber) items—defects that need attention but are not critical—are your blueprint for future maintenance. Use this section to create a simple 1-5 year plan, allowing you to budget for these tasks effectively after you move in. This proactive approach prevents minor issues from escalating into major, expensive problems, protecting your investment for years to come.

Making the Final Decision: Proceed or Pull Out?

Ultimately, your rics homebuyer report delivers the objective clarity needed to make a sound choice. If the survey uncovers issues that are more extensive or costly than you are willing to take on, the best outcome is deciding not to buy. While this can be disappointing, it protects you from a potentially devastating financial mistake and provides invaluable peace of mind, allowing you to continue your search for the right property with confidence.

The Process: Booking Your RICS HomeBuyer Report

Arranging a survey is a straightforward but essential step in your property journey, providing the clarity and confidence needed to make a sound investment. The process is designed to be simple and efficient, moving you from initial instruction to a comprehensive understanding of your potential new home. By following these key stages, you can ensure you are fully informed about the property’s condition before you commit.

Finding and Instructing a Chartered Surveyor

Your first and most important task is to choose a qualified and reliable firm. For complete peace of mind, always select a surveyor that is ‘Regulated by RICS’. This designation is a hallmark of quality, assuring you that the firm adheres to the highest professional standards and offers robust consumer protection. To receive an accurate quote, you will need to provide the property’s address, its age, and the agreed purchase price. Once you instruct the firm, they will handle the logistics, liaising directly with the estate agent to arrange a suitable time for the inspection.

What Happens During the Inspection?

The core of the rics homebuyer report is the on-site inspection. A RICS-Certified surveyor will conduct a thorough but non-invasive visual examination of the property. This typically takes between 2-4 hours, depending on the home’s size and complexity. The surveyor methodically assesses all accessible parts of the property, including:

- The roof structure, chimneys, and external walls.

- Internal walls, ceilings, floors, and joinery.

- Windows, doors, and permanent outbuildings.

- Visible sections of the services (gas, electricity, and water).

Specialist equipment, such as a damp meter, may be used to investigate specific concerns without causing any damage to the property.

Receiving and Understanding Your Report

Following the inspection, you can typically expect to receive your detailed report electronically within 3-5 working days. When it arrives, start by reading the summary section to grasp the main findings. Pay close attention to any defects highlighted with a ‘red’ Condition Rating 3, as these require urgent attention. The process doesn’t end there; we strongly encourage a post-survey call with your surveyor. This conversation is an invaluable opportunity to clarify technical points, discuss the implications of any defects, and plan your next steps with real confidence.

Have questions? Contact our expert team.

Secure Your Investment with Clarity and Confidence

A property purchase is a significant commitment, and this guide has shown how the right survey provides crucial protection. The key takeaways are clear: a rics homebuyer report is the ideal choice for conventional properties, it equips you with essential knowledge about a home’s condition, and it serves as a powerful tool for negotiation or future budgeting. It transforms uncertainty into a clear, actionable plan.

At South Surveyors, our goal is to provide that plan with professionalism and expertise. As a firm Regulated by RICS for your peace of mind, we pride ourselves on our deep expert local knowledge across South London. We deliver clear, professional reports that give you the confidence to move forward on your purchase, fully aware of its condition and value.

Don’t leave your investment to chance. Get a free, no-obligation quote for your RICS HomeBuyer Report today. Make your next move an informed one.

Frequently Asked Questions About the RICS HomeBuyer Report

How much does a RICS HomeBuyer Report cost?

In 2026, the cost of a RICS HomeBuyer Report typically ranges from £400 to £1,000. This price varies based on the property’s value, size, and location. Investing in a professional, RICS-certified survey provides essential peace of mind and clarity. It is a thorough assessment that can uncover issues that may lead to significant unforeseen repair costs, empowering you to negotiate the purchase price or proceed with real confidence in your investment.

How long does it take to get the report back after the survey?

You can expect to receive your detailed and easy-to-understand written report within 3-5 working days following the surveyor’s inspection. We understand that property purchases are time-sensitive. To provide immediate clarity, our RICS-certified surveyors will often contact you by phone on the day of the survey to discuss any significant findings, ensuring you can make timely and informed decisions while you await the comprehensive document.

What’s the difference between a HomeBuyer Report with and without a valuation?

The RICS Home Survey Level 2 (the official name for a HomeBuyer Report) is available in two formats. The survey *with* a valuation provides a professional opinion of the property’s market value and a reinstatement cost for insurance purposes. The version *without* a valuation focuses solely on the property’s condition. We generally recommend the valuation option to ensure you are paying a fair price, providing you with complete clarity and confidence.

Can a surveyor check for things like asbestos or Japanese Knotweed?

A RICS surveyor is expertly trained to identify the visual signs that suggest the presence of asbestos, Japanese Knotweed, or other potential hazards. While they are not specialist testers, they will flag these areas as risks in the report. If such issues are suspected, your surveyor will provide a professional recommendation for you to arrange a further, more detailed investigation by a qualified specialist before you commit to the purchase.

What happens if the surveyor misses a significant defect?

Choosing a firm that is Regulated by RICS gives you a vital layer of protection. All RICS-certified professionals are required to hold Professional Indemnity Insurance. In the unlikely event that a surveyor’s negligence results in a significant defect being missed, you have access to a formal complaints procedure and may be entitled to compensation. This regulation is a cornerstone of the trust and reliability we promise to every client.

Is a HomeBuyer Report suitable for a flat or maisonette?

Yes, a RICS HomeBuyer Report is an excellent and often the most appropriate choice for conventional flats and maisonettes that are in a reasonable condition. The survey provides a thorough assessment of the property’s interior and visible structure. Importantly, it also includes an inspection of the building’s shared areas like the roof, hallways, and external walls, giving you a clear picture of the overall building’s health and potential service charge liabilities.